Zubair Yaqoob

Karachi

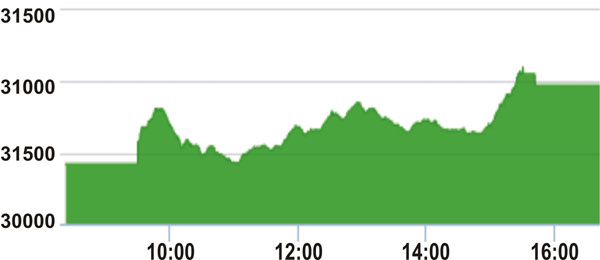

Market continued the ascent on the third consecutive session on Wednesday, with an overall increase of 554pts giving confidence to the retail and institutional Investors alike that perhaps the worst is over. Index heavy weights such as OGDC, HBL, UBL, ENGRO, LUCK played a major role in pulling up the Index. Buying was observed almost across the board, with major impact coming from Banks and Fertilizer sectors. Among scrips, HUBC played a major role in improving the sentiment, whereas TRG and MLCF posted volumes in excess of 10M each. The Index closed at 30,973pts as against 30,419pts showing an increase of 554pts (+1.8% DoD). Sectors contributing to the performance include Banks (+122pts), Fertilizer (+87pts), Power (+85pts), Cement (+77pts), E&P (+69pts). Volumes slightly declined from 142.6mn shares to 134.5mn shares (-6% DoD). Average traded value also declined by 4% to reach US$ 33.8mn as against US$ 35.3mn. Stocks that contributed significantly to the volumes include TRG, MLCF, BOP, ISL and KEL, which formed 30% of total volumes. Stocks that contributed positively include HUBC (+69pts), ENGRO (+64pts), UBL (+55pts), LUCK (+41pts) and HBL (+36pts). Stocks that contributed negatively include IGIHL (-6pts), DAWH (-5pts), BAHL (-4pts), SHFA (-4pts) and EFUG (-4pts).