The Pakistani rupee appeared to be steadily recovering its value against the US dollar and Wednesday saw another positive day for the currency.

Following government’s announcement that Pakistan will receive not one but two tranches from the International Monetary Fund (IMF), the buoyed rupee opened the intrabank trading with a huge lead of Rs1.37 against the US dollar.

According to the forex dealers, the greenback was now being traded at Rs205.50 down by Rs1.37. On Tuesday, the US dollar ended the day at Rs206.87, down by Rs1.07.

Experts said the rupee was able to shed off some pressure after receiving $2.3 billion from a Chinese consortium and a positive news from the IMF.

Earlier, Finance Minister Miftah Ismail had disclosed that the Government of Pakistan had received an MEFP from the IMF for combined 7th and 8th reviews.

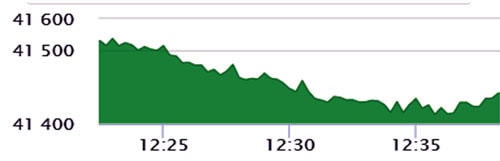

The KSE 100-index of the Pakistan Stock Exchange (PSX) witnessed bearish trend on Wednesday, losing 467.89 points, a negative change of 1.12 percent, closing at 41,297.73 points against 41,765.62 points on the last working day.

A total of 142,192,900 shares were traded during the day compared to the trade of 257,163,743 shares the previous day, whereas the price of shares stood at Rs 5.347 billion against Rs 7.708 billion on last trading day.