Zubair Yaqoob

Karachi

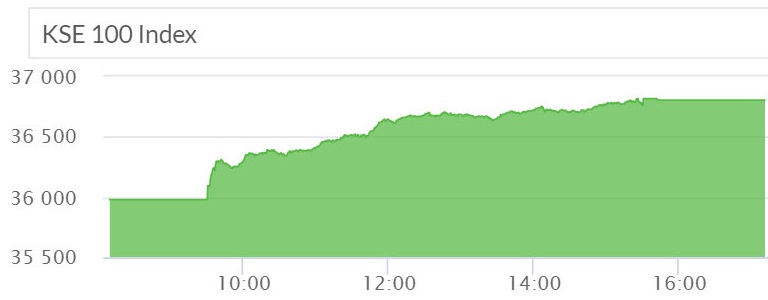

Market surged again with a mammoth 840pts and closed the session near day’s high that too at a time when the index has already increased by ~7000pts from low. Deal with PML (N) being on the cards, besides possible cut in SBP policy rate and MSCI review proving to be a non-event gave confidence to investors and rather than adjusting downwards, as was anticipated (possibly due to overbought levels) the market went up.

Market volumes increased as well over the day, registering trading volumes of 283M shares, contributed mostly by Banks (50.4M) followed by Cement (32.5M) and Technology (30.7M). Among scrips, BOP registered trading volume of 35.9M shares, followed by WTL (14.5M) and MLCF (11.7M). The Index closed at 36,803pts as against 35,978pts showing an increase of +825pts (+2.3% DoD). Sectors contributing to the performance include Banks (+221pts), E&P (+142pts), Power (+108pts), Cement (+82pts) and O&GMCs (+71pts). Volumes increased from 210.6mn shares to 282.9mn shares (+34% DoD). Average traded value also increased from US$ 42.1mn to US$ 58.5mn (+39% DoD).