Zubair Yaqoob

Karachi

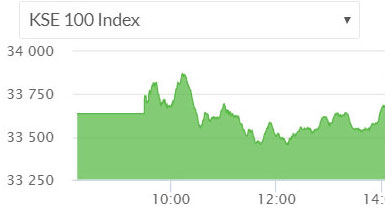

Market traded in a narrow range but oscillated between +235pts and -228pts, and closed the session -160pts (unadjusted). Market has until now seen a gradual ascend with a cumulative increase of 5200pts amidst brief consolidation. The overall sentiment appears still positive, though investors seek profit booking and switching positions from one sector to another. Selling activity was observed generally across the board with disregard to sectorial fundamentals, however, cement sector sustained the most. Traded volume fell short of yesterday’s high volumes, but managed to post a decent number above 200M. Cement sector led the table with 31.9M shares followed by Engineering (26.7M) and Banks (24.6M). Among scrips, UNITY topped the volumes with 21.5M shares, followed by TRG (15.6M) and PAEL (13.3M). The Index closed at 33,476pts as against 33,636pts showing a decline of 160pts (-0.5% DoD). Sectors contributing to the performance include O&GMCs (-31pts), Cement (-29pts), Power (-21pts), E&P (-18pts) and Pharma (-17pts). Volumes declined from 392.1mn shares to 242.9mn shares (-38% DoD). Average traded value also declined by 12% to reach US$ 56.9mn as against US$ 64.7mn. Stocks that contributed significantly to the volumes include UNITY, TRG, PAEL, BOP and PIBTL, which formed 28% of total volumes. Stocks that contributed positively include HBL (+20pts), FFC (+14pts), POL (+11pts), MARI (+11pts) and COLG (+11pts). Stocks that contributed negatively include PPL (-35pts), PSO (-22pts), ENGRO (-20pts), HUBC (-20pts), and SEARL (-15pts).