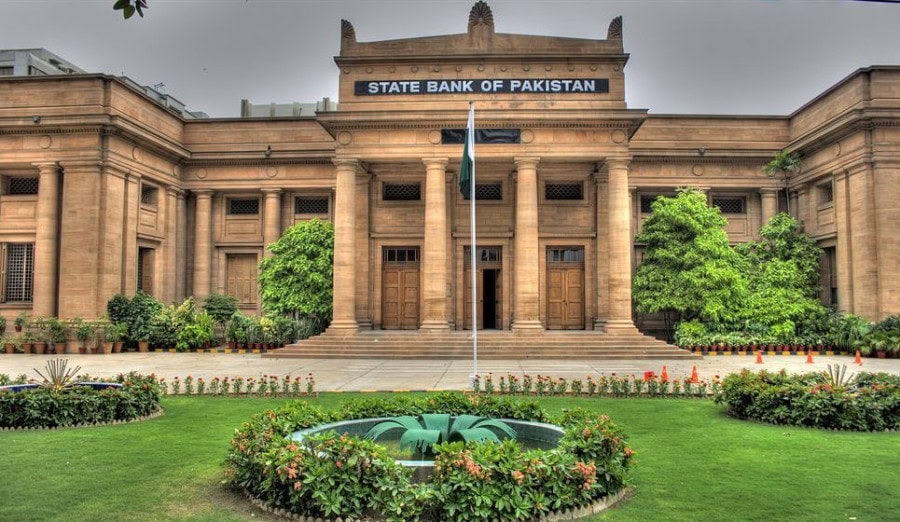

Karachi: The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) is scheduled to meet on Tuesday, 4 April 2023, to decide the key policy rate for the next month and a half.

According to a statement by the central bank, after the meeting of the MPC, the SBP will also issue the monetary policy statement through a press release on the same day.

Monetary Policy Committee of #SBP will meet on Tuesday, April 04, 2023 to decide about the Monetary Policy. #SBP will issue the Monetary Policy Statement through press release on same day.https://t.co/yWtRbsj5Nj pic.twitter.com/4nLPrhulsd

— SBP (@StateBank_Pak) March 31, 2023

This comes as a surprise to many as the meeting of the MPC usually takes place after six to eight weeks. This time, however, the MPC would be meeting again just after four weeks to determine the policy rate because the last meeting took place on March 2.

In the meeting, the MPC had decided to increase the key policy rate by 300 basis points, taking the rate to 20% — the highest in nearly three decades.

This time too the MPC is expected to raise interest rates by at least 200 bps as the cash-strapped government struggles to secure a bailout from the International Monetary Fund (IMF) to boost its beleaguered economy.

Pakistan is undertaking key measures to secure IMF funding, including raising taxes, removing blanket subsidies, and artificial curbs on the exchange rate. While the government expects a deal with IMF soon, media reports say that the agency expects the policy rate to be increased.