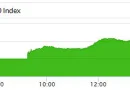

ISLAMABAD – The foreign exchange reserves of Pakistan has increased to $4.43 billion after a $394 million loan from a Chinese bank.

Data shared by the country’s central bank shows that its foreign exchange reserves moved up by $394 million, hovering at $4.43 billion. Meanwhile, the total liquid foreign reserves held by the country stood at $9.96 billion.

In a statement, State Bank said “During the week ended on April 14, 2023, the bank reserves increased by $394 million to $4,432.5 million. The increase in SBP reserves is mainly due to the receipt of $300 million of commercial loan”.

Amid the recent developments, the country’s finance chief Ishaq Dar claimed that IMF was satisfied with his government’s measures. Staff-level agreement is expected to be in the next few days after friendly nations gave assurances.

The IMF is seeking “necessary” financing assurances at the earliest to conclude talks with Pakistan on its stalled bailout, Fund’s mission chief for Pakistan, Nathan Porter, confirmed last week.

It should be noted that the $6 billion financing gap had been worked out on the assumption that the current account deficit would remain around $7 billion in the current fiscal year.

According to sources, Islamabad has informed the Washington-based lender about its plan to secure a $450 million worth second Resilient Institutions for Sustainable Economy (RISE-II) budget support loan.

Plans to get $1 billion from Asian Infrastructure Investment Bank and other commercial banks were also shared with the Fund officials along with plans to materialise pledges. The sources added that once the staff-level agreement is signed with the IMF, it would become easy for Pakistan to secure financing.