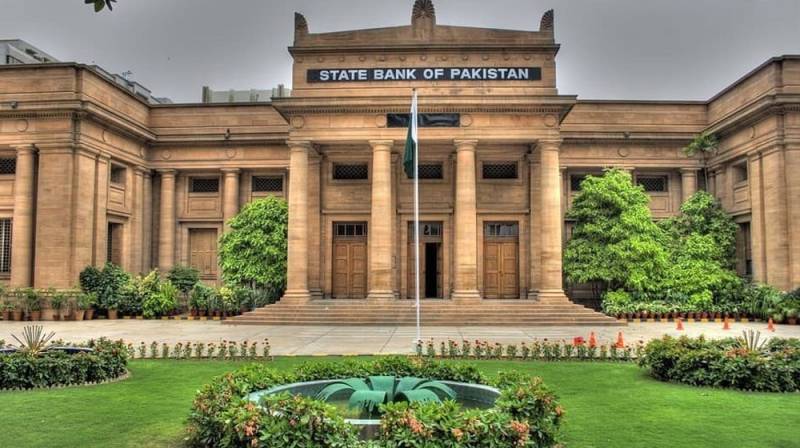

In a major development, State Bank of Pakistan (SBP) announced a 200 basis point reduction in the key policy rate on Thursday, which now stands at 17.5 percent.

In a statement, the MPC said, “At its meeting today, the Committee decided to reduce the policy rate by 200 basis points to 17.5%, effective from September 13, 2024.”

The statement highlighted that both headline and core inflation had significantly decreased over the past two months, surpassing the Committee’s earlier expectations. This decline was primarily attributed to the delay in implementing planned increases in energy prices and favorable trends in global oil and food prices.

Martket experts shared prediction about cut of 150 basis points. The upcoming decision by the MPC is particularly noteworthy, following previous cuts totaling 2.5 percentage points in recent months.

As of now, the inflation reached 38pc earlier this year, recent drops have opened the door for the government to improve liquidity in the private sector.

The lowering borrowing costs will furth encourage investment and boost economic activity, which is vital for creating jobs, especially for the younger population. The growth rate for the current fiscal year is forecasted to rise to 3.5%, compared to 2.4% in FY24.

The central bank said MPC’s move indicates a careful yet optimistic approach. Although inflation control has advanced, there are still uncertainties regarding energy prices and global commodity markets. The rate reduction aims to address these risks while maintaining macroeconomic stability and encouraging sustainable growth.

It mentioned moderate uptick in economic activity, with domestic cement and petroleum sales rising by 8.5% and 6.8% month-on-month in August, respectively. Manufacturing firms have reported increased capacity utilization. However, the agricultural sector is facing challenges due to anticipated cotton production shortfalls. The MPC has maintained its growth forecast of 2.5-3.5% for FY25.

Betterment of remittances and improved export earnings balanced higher imports, keeping the current account deficit at $0.2 billion. This positive trend continued into August. The MPC expects the current account deficit to remain within 0-1% of GDP for FY25, supported by strong remittance inflows and IMF program assistance.

MPC also mentioned headline inflation that fell to 9.6pc YoY in August 2024, down from 12.6pc in June, with core inflation decreasing to 11.9% from 14.1%. This decline is attributed to improved food supplies, favorable global commodity prices, and postponed energy price hikes.

Nevertheless, risks persist, including high core inflation, rising consumer inflation expectations, and potential new tax measures. The MPC forecasts that FY25 average inflation may drop below the previously estimated range of 11.5-13.5%, provided fiscal and external targets are achieved.

Overall, the MPC’s decision reflects a strategic effort to manage inflation and economic stability amid ongoing challenges.