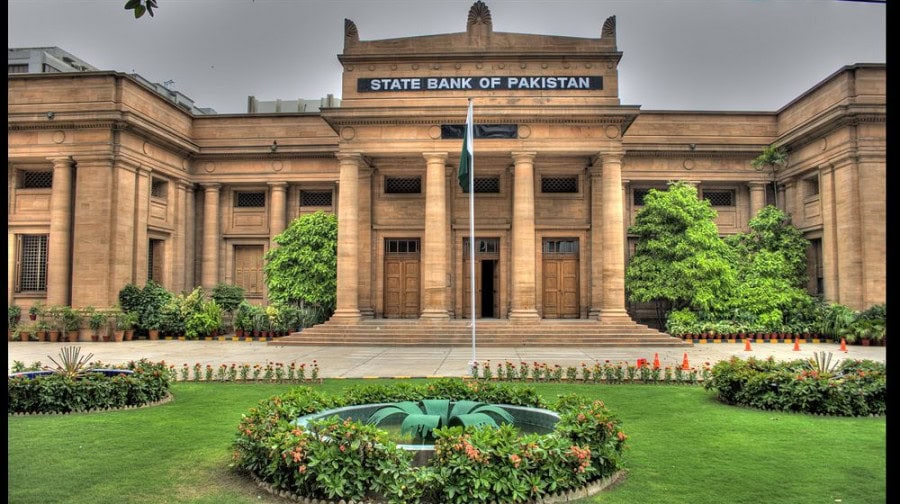

The State Bank of Pakistan (SBP) is the prime regulator of the financial and banking system. As such, SBP has not only played an important role in strengthening the financial system of the country by proactively adopting monetary stance but it also has taken many steps to facilitate consumers in availing banking services.

This era is witnessing the evolution of finance and technology which has led to the formation of financial-tech institutions. As a result we have experienced many innovative products which offers great value addition and efficiency.

However, the development of such products have resulted in complex challenges from consumers’ protection point of view. This necessitates the increased role of financial regulators to diligently deal with the consumer protection challenges and issue appropriate regulations to ensure consumers are protected to reap the benefits of fintech revolution.

It is imperative to have a robust and efficient compliant handling tool at our disposal. In case of Pakistan people have various issues with using banking services in general and technological revolution has further added complexities. Therefore, the significance of an up to date consumer protection regime cannot be stressed enough.

The State Bank of Pakistan (SBP) has taken many steps and issued regulations with an idea to promote fair treatment of consumers and tackle grievances of consumers in availing financial services in the country.

The SBP has directed all Banks, microfinance banks and Development Finance Institutions to ensure that they have a robust mechanism in place to address consumers’ complaints. The focus has been made on the efficiency of consumer grievances handling mechanisms as it has remained a dilemma in Pakistan that a complaint takes many months to get resolved.

SBP has currently revised complaint handling mechanism that is present at financial institutions at the moment.

The review is based on the ‘ease of lodgment’, and ‘quick and fair disposal’ of complaints. After a thorough analysis, SBP issued new set of instructions to all banks, DFIs and MFBs. These instructions have made it essential for all financial institutions to ensure mandatory modes of complaint lodgment and emphasis has been made on the availability and accessibility. Primarily, these include Call Centers, Emails, E-forms, Surface mail, Fax, and Complaint boxes/registers.

Along with this, banks may invest in modern modes to lodge complaint including the use of smartphones, Mobile applications, Self Service Kiosks and other Social Media Platforms.

It has also been advised by SBP that financial institutions should invest in technological framework needed to improve consumer experience and invest on human capital development to handle consumer complaints in a better way. Along with this, SBP has recommended banks, DFIs, MFBs to ensure consumers have access to complaint tracking system to improve efficiency and strength the overall consumer protection regime.—INP