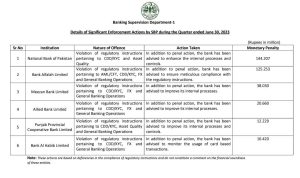

LAHORE – The State Bank of Pakistan (SBP) has imposed monetary penalties amounting to Rs350.799 million on six banks for violations of regulatory instructions during the quarter ended on June 30, 2023.

According to the details shared by the SBP, National Bank of Pakistan (NBP) was found guilty of violation of regulatory instructions pertaining to Customer Due Diligence (CDD)/ Know Your Customer (KYC) and asset quality.

While imposing monetary penalty of Rs144.207 million, NBP has been advised to enhance the internal processes and controls.

Bank Alfalah Limited was found guilty of violation of instructions pertaining to Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT), CDD/KYC, foreign exchange (FX) and general banking operations.

Monetary penalty of Rs125.253 million has been imposed. The bank has been advised to ensure meticulous compliance with the regulatory instructions.

Monetary penalty of Rs38.030 million has been imposed on Meezan Bank Limited for violation of regulatory instructions pertaining to CDD/KYC, FX and general banking operations. The bank has been advised to improve internal processes.

SBP has imposed a monetary penalty of Rs20.660 million on Allied Bank Limited for violation of regulatory instructions pertaining to CDD/KYC, FX and general banking operations. The bank has been advised to improve its internal processes.

Punjab Provincial Cooperative Bank Limited was found guilty of violation of regulatory instructions pertaining to CDD/KYC, asset quality and general banking operations. Monetary penalty of Rs12.229 million has been imposed. The bank has been advised to improve its internal processes and controls.

Monetary penalty of Rs10.42 million has been imposed on Bank Al Habib Limited for violations of regulatory instructions pertaining to CDD/KYC, FX and general banking operations. In addition to penal action, the bank has been advised to monitor the usage of card-based transactions.