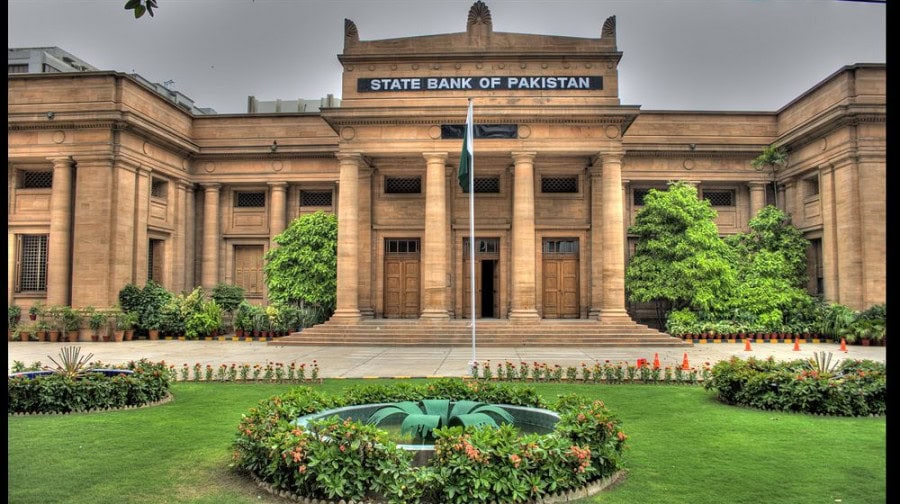

SBP issued “Licensing and Regulatory Framework for Digital Banks” to create awareness of this important development in regulatory ambit, SBP organized an online event “Digital Banks – A New Era in Banking”.

The objective of the webinar was primarily to create awareness about the next generation of banks i.e.

digital banks and the potential they offer for financial inclusion in the country.

It was also aimed at sharing the details of digital banking framework amongst the market participants and prospective investors and to address their queries.

Dr.Reza Baqir, Governor State Bank of Pakistan in his keynote address highlighted the potential of digital financial services to become ubiquitous in the banking industry and its significance in terms of inclusion and innovation.

Discussing the prospects of digital banks in Pakistan, heemphasized that one of the key goals of the State Bank of Pakistan was to promote inclusion, innovation, and modernization of financial sector of Pakistan.

He emphasized SBP’s expectations from digital banks in promoting financial inclusion by providing affordable financial services to unserved and underserved segments of society, alongside fostering a new set of customer experience.

Dr.Baqir highlighted how digitization of financial services is picking up pace and is transforming the way banking is done for both individuals and businesses.

He mentioned that Pakistan’s journey for digital financial services started in early 2000s, and since then, a number of enabling regulatory initiatives were launched.