Doha

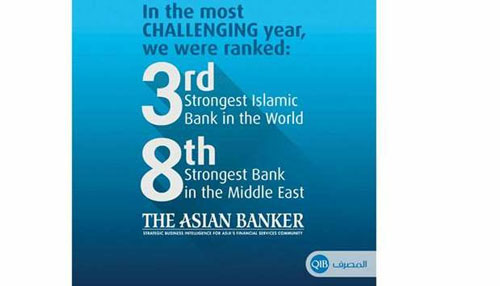

The Asian Banker magazine has ranked Qatar Islamic Bank (QIB) as the ‘Third Strongest Islamic Bank in the World’ and ‘Eighth Strongest Bank in the Middle East’ in its 2020 rankings of the 500 strongest banks.

The Asian Banker’s 500 strongest banks rankings is one the world’s highly-credible and widely followed annual rankings of strongest banks based on financial statements.

The rankings are based on detailed and transparent scorecards that rank commercial and Islamic banks on six areas of financial performance, including the ability to scale, balance sheet growth, risk profile, profitability, asset quality, and liquidity.

With the new rankings, QIB marks significant progress from its 2019 rankings, and is now ‘Third Strongest Islamic Bank in the World’ and ‘Eighth Strongest Bank in the Middle East’. In 2019, QIB was ranked ‘Seventh Strongest Islamic Bank in the World’ and ‘19th Strongest Bank in the Middle East’.

The new rankings reflect QIB’s continuous improvement in performance and stability over the past 12 months, its ability to withstand business continuity considering the Covid-19 pandemic, and its success in maintaining its longstanding position as Qatar’s largest private bank, the largest Islamic bank in the country, and a leading Islamic bank globally.

QIB was able to contain the ratio of non-performing financing assets to total financing assets at 1.3% reflecting the quality of the bank’s financing assets portfolio. QIB continued to pursue the conservative impairment provisioning policy and has more than doubled the financing impairment charges and continues to maintain 100% coverage ratio for non-performing financing assets. QIB also successfully closed a $750mn five-year sukuk issuance in 2020 and maintained a well-diversified funding profile. QIB Group CEO Bassel Gamal said, “We are pleased with our new rankings as ‘Third Strongest Islamic Bank in the World’ and ‘Eighth Strongest Bank in the Middle East’, recording a significant improvement in ranking compared to 2019.

“This is indeed a confirmation of QIB’s outstanding performance over the past year on the level of financial stability despite the challenges posed by the coronavirus pandemic.” He added: “QIB is a leading bank that is contributing in reshaping finance in Qatar and beyond over the past few years, through investing in innovation and digital banking services.—Gulf News