Doha

Qatar could play a key role in fast-tracking the development of the Islamic finance industry in non-Muslim countries, according to experts from Carnegie Mellon University in Qatar (CMU-Q).

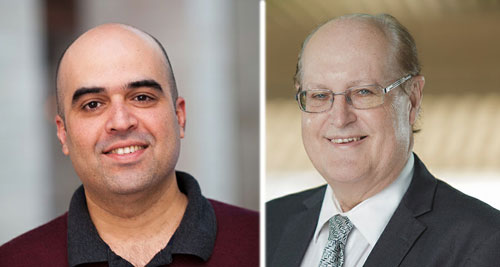

John O’Brien, senior associate dean, faculty and outreach, and associate professor of Accounting and Experimental Economics; and Fuad Farooqi, area head, Business Administration, and associate teaching professor, Finance; said in a statement to Gulf Times: ‘Qatar is well-placed to being a positive catalyst for promoting such opportunities.

The experts stated that this could lead to attracting some cross listings on the Qatar Stock Exchange (QSE), as well as further enhancing the growth opportunities for the Islamic banking sector in Qatar.

‘The developments evolving with Turkey, Malaysia, and the Philippines are prime examples of what can result by having the separation of the banking sectors in Qatar.

This is because each sub-sector is now free to pursue its comparative advantages. This can include helping to fast-track the development of the industry in non-Muslim countries, they pointed out.

Asked about the factors that are essential in promoting the growth of Islamic finance among non-Muslim countries, the experts agreed that Islamic banking’s strengths and experience with promoting ethical finance ‘provides the ideal path to growth in non-Muslim countries.

‘As we have seen with the conventional investments, ease of investor access is a critical factor in the growth of international markets.

Variations in the Shariah interpretation and approvals can be a limiting factor for growth in the Islamic finance markets.

Once the industry develops a common Shariah compliance platform, we expect the markets to open to investors from across the globe and we should see high growth, the experts explained.

The experts noted that the ‘supportive role that the academic community can play is both in terms of research and training.

‘There is a large body of conventional banking research and a much smaller body of Islamic banking research.

The more research that is focused upon understanding the strengths and weaknesses of each banking business model, the more efficient the Islamic banking sector can become relative to the conventional banking sector.

The separation of the two sectors in Qatar results in greater transparency, which in turn helps promote more focused comparative research into each sector. Ultimately this results in better-trained graduates.

‘For example, at CMU-Q we offer courses in banking that teach both Islamic and conventional banking.

This includes site visits for students, so they can see how Qatar’s separation of the two banking business models works in practice.

When combined with the conceptual framework taught in the classroom, this allows for students to develop a better appreciation for both the strengths and weaknesses of each sector, they said.

On exchange traded funds (ETFs) and the potential of having more Islamic ETFs, the experts said, ‘Currently, if we compare the average performance of stocks in the Islamic ETF versus stocks in the Qatar Stock Index along some important dimensions, it is favourable (eg, P/E ratio 15.72 versus 15.09, Dividend Yield 4.88% versus 4.3%, Return on Assets (ROA) 5.6% versus 4.3% and Year to Date stock market performance -0.1% versus -2.1%.

‘These numbers show that the Islamic ETF is maintaining healthy numbers relative to the QSE Index, which serves to enhance its attractiveness to the general investing public.

If we were making a prediction about future ETFs, we would say that given the strength and separation within the banking sector there is an opportunity for creating separate banking ETFs (especially an Islamic banking ETF).

They added: ‘As we understand, there has traditionally been a high demand for Islamic assets. The introduction of additional ETFs should attract liquidity to the stock market and help improve market efficiency and price discovery.—MENAFN