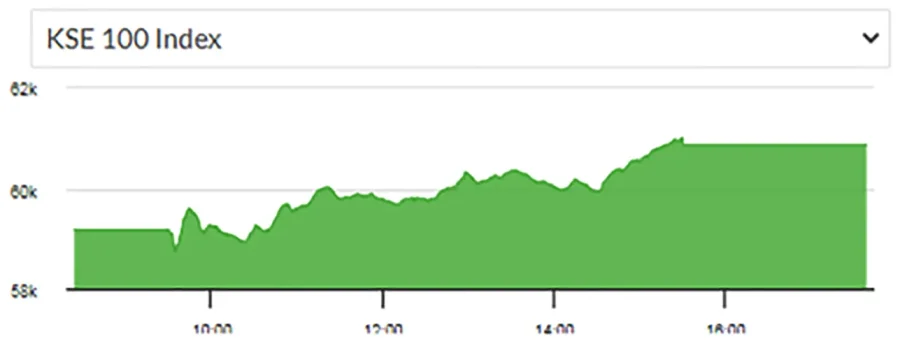

A day after witnessing the biggest day-on-day decline in the benchmark of major shares, the Pakistan Stock Exchange’s (PSX) benchmark index returned to trading in the green on Wednesday.

According to the PSX website, the KSE-100 index gained 1692.65, or 2.86 per cent, to stand at 60,863.62 from the previous close of 59,170.97, effectively halting the bearish momentum that had continued throughout the week previously.

On Tuesday, the KSE-100 index had dropped 2,534 points or 4.1 per cent from the preceding session to 59,170.97 points, down 11pc from an all-time high of 66,427 points on Dec 12.

Raza Jafri, head of equities at Intermarket Securities, noted that the benchmark index had bounced up from “technical support levels”. He also said that it appeared that “the high leverage issue” was left behind, which helped the recovery.

Tahir Abbas, head of research at Arif Habib Limited, said that the market was recovering after “yesterday’s bloodbath”. He noted that the index had corrected around 11pc overall from its bullish run.

He also called attention to the fact that the index was still trading at an attractive price-to-earning ratio of 4.1x, in comparison to the previous five year average of 5.9x.