Pakistan Stock Exchange (PSX) made a modest recovery in the last week over news of expected massive foreign investment in Pakistan and the rupee’s rapid recovery against the US dollar in retail trade.

Such economic developments sparked hopes among investors, who resorted to accumulating lucrative stocks in the hope of getting handsome returns later.

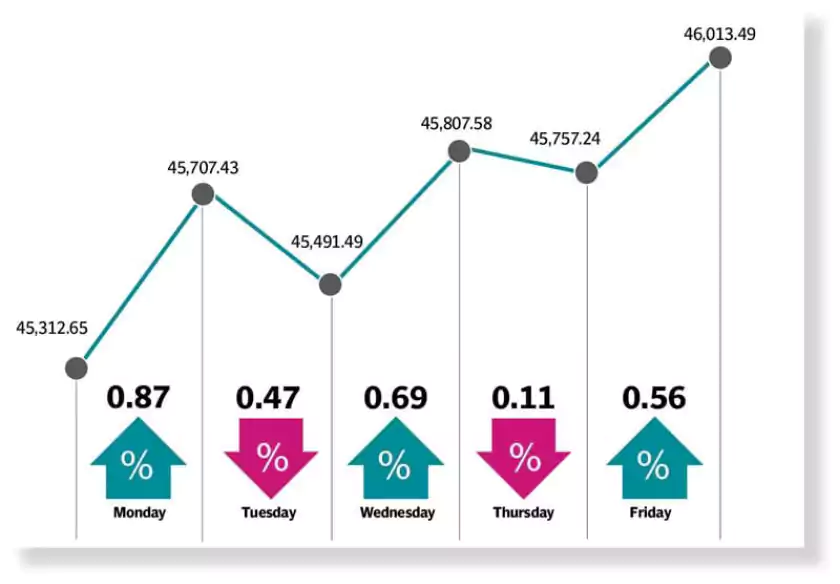

At the beginning of the week, the bourse made robust gains of nearly 400 points on expectations of Saudi crown prince’s visit to Pakistan to discuss big investment plans with the Special Investment Facilitation Council (SIFC) and a lower-than-expected Consumer Price Index (CPI) inflation reading. The benchmark KSE-100 index retreated on Tuesday as it lost the previous day’s momentum despite hopes of Pakistan receiving billions of dollars in investment from Gulf countries.

Factors like a possible policy rate hike by 150-200 basis points and failed attempts on part of the government to persuade the International Monetary Fund (IMF) for a relief in power tariffs dented investors’ sentiment. The very next day, the market rebounded in the wake of a significant rupee appreciation in the open market. The index surged over 300 points, driven also by strong expectations of Gulf investment in the country.

On Thursday, the KSE-100 index ended slightly lower in a range-bound session, haunted by the talk of a hike in policy rate in the upcoming monetary policy meeting. However, the index ended the week on a bullish note. Optimism regarding the potential visit of Saudi Crown Prince Mohammad bin Salman to Pakistan to finalise $25 billion in investment from Gulf countries under SIFC initiatives bolstered investors’ interest.

The KSE-100 index closed the week at 46,013 points, up 701 points, or 1.5% week-on-week (WoW). JS Global analyst Muhammad Waqas Ghani wrote in his market review that the week began on a positive note, thanks to the release of August CPI inflation figures on Friday evening last week. They showed a year-on-year increase of 27.4%, which came in below market consensus.

During the week, the rupee strengthened to Rs305 in the open market, gaining 9% WoW. On the news front, the provision of relief in electricity bills remained under discussion, with the government facing hurdles in the way of providing any concession without IMF’s approval.

In other news, the government was considering strategies, including anti-theft/ recovery efforts, energy conservation through early shop closures and negotiations to revise power purchase agreements with CPEC independent power producers (IPPs) to deal with power-sector issues.

“Investment opportunities under SIFC also remained a topic of discussion under which the government eyes heavy investments from Gulf countries,” he said.