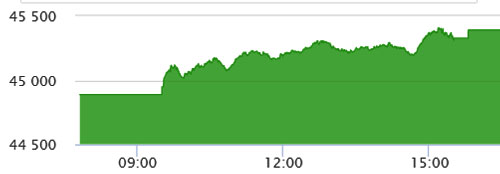

The Pakistan Stock Exchange (PSX) turned positive on Tuesday as the push to de-escalate tension at the Ukrainian border and avert a Russian invasion is in high gear, with the benchmark KSE-100 Index gaining 87.61 points (+0.19 percent) to close at 45,731.70 points.

The market opened on a slight positive note but turned to the negative territory soon and remained in the red till it bounced back in the last hour trading, closing in the green.

The news of some Russian troops’ withdrawal from the Ukrainian border helped global markets rally and the PSX followed suit.

Moreover, an expected decrease in thermal coal prices also supported the cement sector. Similarly, a decline in international oil prices also led the market to close in green territory.TLTP

The KSE-100 Index moved in a range of 301.19 points, showing an intraday high of 45,804 points and a low of 45,502.81 points. Among other indices, the KSE All Share Index gained 59.01 points (+0.19 percent) to close at 31,334.77 points, while KMI All Share Islamic Index gained 58.84 points (+0.26 percent) to close at 22,633.29 points.

A total of 350 companies traded shares in the stock exchange, out of them shares of 205 closed up, shares of 126 closed down while shares of 19 companies remained unchanged. Out of 92 traded companies in the KSE-100 Index, 60 closed up, 30 closed down and two remained unchanged.

The overall market volumes increased by 86.77 million to 274.58 million shares. Total volumes traded for the KSE-100 Index increased by 13.66 million to 98.23 million shares. The number of total trades increased by 2,455 to 101,792, while the value traded increased by Rs0.81 billion to Rs6.76 billion. Overall, market capitalisation increased by Rs14.72 billion.

Among scrips, WTL topped the volumes with 91.9 million shares, followed by KEL (22.71 million) and TELE (10.11 million). Stocks that contributed significantly to the volumes included WTL, KEL, TELE, TPLP and TRG, which formed over 52 percent of total volumes.

In terms of rupee, BATA remained the top gainer and witnessed an increase of Rs64.17 (3.04 percent) per share, closing at Rs2,172.5 whereas the runner-up was PRET, the share price of which climbed up by Rs30.78 (4.4 percent) to Rs729.99.

AWTX remained the top loser in terms of rupee and witnessed a decrease of Rs161.3 (7.5 percent) per share, closing at Rs1,989.43, followed by GATI, the share price of which declined by Rs34.5 (6.96 percent) to close at Rs461.5 per share.

The sectors taking the index towards north were fertilizer with 31 points, technology & communication (31 points), automobile assembler (19 points), cement (14 points) and investment banks/ investment companies/ securities companies (11 points).

The most points added to the index were by ENGRO which contributed 22 points followed by TRG (19 points), AVN (18 points), MTL (16 points) and ABL (12 points).

The sectors taking the index towards south were power generation & distribution with 37 points, oil & gas exploration companies (15 points), commercial banks (8 points), tobacco (7 points) and pharmaceuticals (4 points). The most points taken off the index were by HUBC which stripped the index of 45 points followed by PPL (20 points), AKBL (16 points), and HBL and MEBL (10 points each). TLTP