The Pakistan Stock Exchange (PSX) witnessed intense selling pressure on Wednesday as the benchmark KSE-100 index shed 641.21 points, two days after it lost almost 1,500 points.

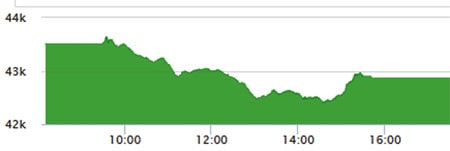

According to the PSX website, the KSE-100 Index opened at 43,504.36 points and made a high of 43,649.59 points. It then started going down before closing at 42,863.15 points, which represented a decline of 641.21 points.

Today’s decline comes two days after the PSX witnessed a meltdown during which the KSE-100 lost 1,447.67 points.

Share prices nosedived as investors expressed worries about the country’s debt repayment capacity amid depleting foreign exchange reserves.

Meanwhile, the dollar reached an all-time high against the rupee earlier on Wednesday, breaching the Rs190 mark in the interbank.

The greenback appreciated by Rs1.44, surpassing Tuesday’s close of Rs188.66. The last time the dollar reached an all-time high was on April 1, when it crossed the Rs189 mark.

The rupee is under pressure due to the higher oil import bill and speculation awaiting the Saudi package, Ahsan Mehanti, director of Arif Habib Group told Mettis Global.

General secretary of the Exchange Companies Association of Pakistan, Zafar Paracha, said delays in talks with the International Monetary Fund was putting pressure on foreign reserves.