ISLAMABAD – Pakistan has increased its key interest rate to 20 percent, the highest in nearly 3 decades, as the economy of the fifth most populous country grapples with skyrocketing inflation, dwindling currency reserves and stalled IMF program.

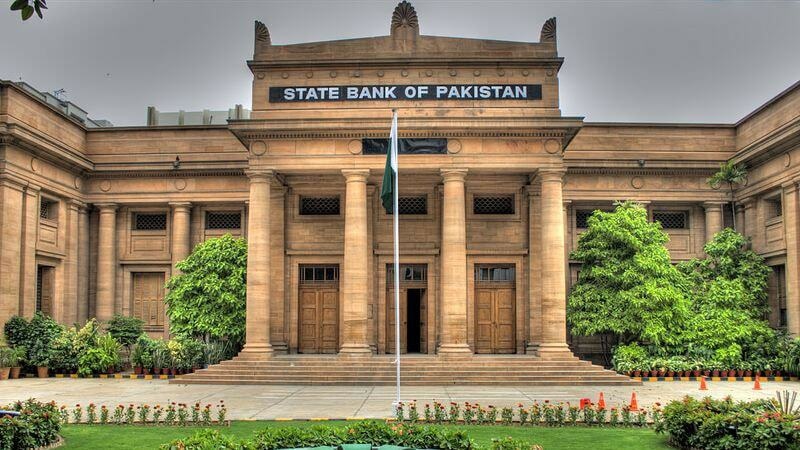

In a statement, the central bank said Monetary Policy Committee (MPC) has raised the key interest rate by 300 basis points, in another desperate move to control runaway inflation.

The press release issued by the State Bank of Pakistan said “During the last meeting in January, the Committee had highlighted near-term risks to the inflation outlook from external and fiscal adjustments. Most of these risks have materialised and are partially reflected in the inflation outturns for February. The national CPI inflation has surged to 31.5 percent y/y, while core inflation rose to 17.1 percent in urban and 21.5 percent in rural basket in February 2023.”

1/3 The Monetary Policy Committee decided to raise the policy rate by 300 basis points to 20 percent in its meeting today. https://t.co/8ceKtaFu3j pic.twitter.com/OZA85p0Ewx

— SBP (@StateBank_Pak) March 2, 2023

The officials of central bank flagged fiscal adjustments and exchange rate depreciation for massive deterioration in the near term inflation outlook.

Inflation will rise further in the coming months as the impact of these adjustments unfolds before it begins to fall, albeit at a gradual pace, the central bank maintained. The average inflation is said to be hovering between 27-29 percent against the November 2022 projection of 21–23 percent.

Monetary Policy Committee stressed that anchoring inflation expectations is critical and warrants a strong policy response.

Sharif-led government agreed before the International Monetary Fund (IMF) to increase the policy rate as it remained of the key conditions to secure the stalled bailout package.

This is a developing story, and will be updated later…