Zubair Yaqoob

Karachi

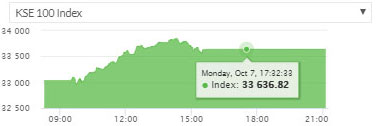

PM’s visit to China took precedence over AsiaPacific Group’s (APG) latest release of its report on Pakistan’s compliance with recommended measures to counter AML/CFT, which will also be subject of discussion from mid of October at FATF plenary session. Investors are hopeful of PM’s visit to China and believe that the outcome will be positive for Pakistan. After an initial drop of 86pts earlier in the session, the market went ahead with a jump of 818pts and closed the session +595pts (unadjusted). Today, yet again, proved to be highest volumes traded session in last 12 months with 391.5M shares. Majority of the volumes were observed in Banking sector with 68M shares (contributed by BOP (40M), which was followed by Cement (44M) and Technology (40M). Among scrips, UNITY and KEL followed BOP with 25M shares and 17M shares respectively. The Index closed at 33,637pts as against 33,033pts showing an increase of 604pts (+1.8% DoD). Sectors contributing to the performance include Banks +198pts), E&P (+103pts), Cement (+67pts), Fertilizer (+54pts) and O&GMCs (+45pts). Volumes increased substantially from 261.8mn shares to 392.1mn shares (+50% DoD). Average traded value also increased by 35% DOD to reach US$ 64.6mn as against US$ 47.7mn.