Zubair Yaqoob

Karachi

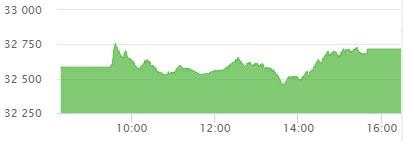

Market opened on a positive note with +17pts but faced selling pressure that took the index down by 129pts. Prime Minister’s ongoing visit to USA was well received by the media and political analysts, but failed to garner the support as anticipated by stock traders. By the end of session, cement and steel sector scrips saw better price performance and stocks like DGKC, MLCF, ISL were seen traded at upper circuits. Much of this activity is attributed to short covering by investors, which have been selling bearish on these sectors due to anticipation of poor results. Overall volumes reached close to 100M today, mainly led by Cement Sector with ~24M shares (contributed by MLCF (13M)) and followed by Technology (13M) contributed by WTL’s 8M. The Index closed at 32,716pts as against 32,585pts showing an increase of 131pts (+0.4% DoD). Sectors contributing to the performance include Cement (+43pts), Fertilizer (+27pts), Banks (+18pts), E&P (+17pts) and Pharma (+16pts). Volumes more than doubled from 44.5mn shares to 96.9mn shares (+117% DoD). Average traded value also increased by 75% to reach US$ 21.7mn as against US$ 12.4mn. Stocks that contributed significantly to the volumes include MLCF, UNITY, WTL, FFL and PAEL, which formed 44% of total volumes. Stocks that contributed positively include FFC (+26pts), EFERT (+14pts), HBL (+13pts), UBL (+11pts) and FCCL (+10pts). Stocks that contributed negatively include NESTLE (-16pts), ENGRO (-11pts), HUBC (-7pts), NATF (-6pts) and IGIHL (-6pts).