Zubair Yaqoob

Karachi

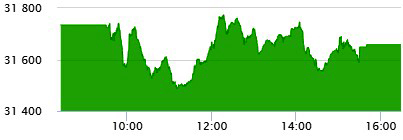

Market traded mostly in negative zone with a total loss of 248pts, which narrowed by the end of session close to -76pts and closing at 31,658pts. E&P, Refinery with the exception of O&GMCs contributed to selling pressure. Besides, Cement sector continued the downtrend while leading the volumes on the index. For the past 3 months, except for the rollover week, Cement sector stocks have been coming off gradually. Although the overall volumes registered a notch above 50M (still anemic), volumes were mainly contributed by Cement Sector (13.5M), followed by Banks (5.7M) and Technology (5.1M). MLCF topped the chart with 4.7M shares followed by TRG (3.8M). The Index closed at 31,658pts as against 31,734pts showing a decline of 76pts (-0.2% DoD). Sectors contributing to the performance include Commercial Banks (-41pts), Tobacco (-27pts), Cement (-17pts), Food and Personal Care Products (-13pts), and E&Ps (-13pts). Volumes increased from 45.8mn shares to 51.3mn shares (+12% DoD). Average traded value also increased by 40% to reach US$ 13.2mn as against US$ 9.4mn. Stocks that contributed significantly to the volumes include MLCF, TRG, KEL, FCCL and PAEL, which formed 35% of total volumes. Stocks that contributed positively include POL (+18pts), ENGRO (+12pts), and BAFL (+8pts). Stocks that contributed negatively include PAKT (-27pts), HBL (-27pts), PPL (-19pts), OGDC (-18pts) and NESTLE (-13pts).