Zubair Yaqoob

Karachi

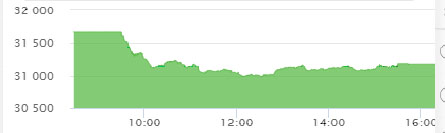

Weekend news flow became ominous for the 100 index. Market lost 687pts in total and closed 486pts from Friday’s closing. Declining cement dispatches, Concerns raised by O&GMCs on RLNG intake and India’s amendment in its Parliament relating to Kashmir caused a major blow to Investor sentiment. Resultantly, Banks, Power, Steel, Cement, E&P etc traded in red and contributed most to the downfall of Index. Overall volumes reached 52M, led by Cement Sector. MLCF ranked highest on the volumes table with 4.8M shares, followed by TRG (4.2M) and ISL (3.5M). The Index closed at 31,181pts as against 31,666pts showing a decline of 486pts (-1.5% DoD). Sectors contributing to the performance include Banks (-195pts), E&P (-75pts), Power Generation (-52pts), Fertilizer (-42pts) and O&GMCs (-26pts). Volumes increased from 46.5mn shares to 52.0mn shares (+12% DoD). Whereas, average traded value registered a decline of 12% DoD to reach US$ 11.3mn as against US$ 12.8mn. Stocks that contributed significantly to the volumes include MLCF, TRG, ISL, BOP and KEL, which formed 34% of total volumes. Stocks that contributed positively include NESTLE (+10pts), BAHL (+5pts), FATIMA (+4pts), ABL (+2pts) and ABOT (+2pts). Stocks that contributed negatively include UBL (-74pts), MCB (-41pts), HBL (-39pts), HUBC (-37pts) and PPL (-35pts).