Staff Reporter

Karachi

The bulls maintained their grip on the Pakistan stock market for the fourth consecutive day as the benchmark KSE-100 index powered past the 38,500-point mark with a rise of 209 points on Wednesday.

The positive activity came on the back of a decision by the Economic Coordination Committee (ECC) of the cabinet on revising petroleum product prices on a fortnightly basis to help the oil sector to increase its profit.

The uptrend was further fuelled by a rise in crude prices in the international market, offsetting demand concerns, coupled with the recovery in rupee’s value.

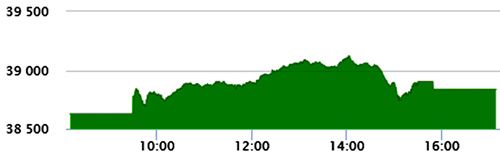

Earlier, trading began on a positive note, which propelled the index above 39,000 points in intra-day trading. However, the momentum could not be sustained and towards the end bears wiped off some of the gains. At close, the benchmark KSE-100 index recorded an increase of 209 points, or 0.54%, to settle at 38,836.27 points.

Banking, steel, chemical and fertiliser sectors recorded profit-booking before the last trading day of the week. Among exploration and production companies, Pakistan Petroleum Limited (PPL) sustained selling pressure amid high volumes.

The power sector led the volumes with trading in 93.7 million shares, followed by cement companies (60.7 million) and technology firms (60.2 million). Sectors contributing to the performance included cement (+62 points), power (+59 points), exploration and production (+49 points), oil and gas marketing (+25 points) and insurance (+23 points).