Staff Reporter

Karachi

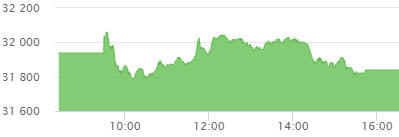

Market traded in a narrow range with an oscillation between -158pts and +122pts, and ended the session at -99pts. O&GMCs, Cement and Chemicals traded in red most of the session, whereas Steel continued moving upward, carrying the trend from Wednesday.

Large cap Banks and Cement contributed mostly to the downside in Index. Cement Sector led the volumes table with 21.6M shares, followed by Technology (7M) and Engineering (5.5M). Among scrips, MLCF topped the chart with 10.6M shares followed by TRG (5.3M) and FCCL (4.8M).

The Index closed at 31,839pts as against 31,938ts showing a decrease of 99pts (-0.3% DoD). Sectors contributing to the performance include Banks (-38pts), E&P (-15pts), Power (-14ts), Food (-13pts), and Pharmaceuticals (-11pts).

Volumes increase from 70.2mn shares to 70.7mn shares (+0.6% DoD). Average traded value decreased by 23% to reach US$ 12.6mn as against US$ 16.4mn. Stocks that contributed significantly to the volumes include MLCF, TRG, FCCL, UNITY and PAEL, which formed 40% of total volumes. Stocks that contributed positively include FCCL (+11pts), POL (+9pts), PKGS (+8pts), APL (+5pts) and FATIMA (+5pts). Stocks that contributed negatively include PPL (-25pts), MCB (-18pts), BAHL (-15pts), FFC (-11pts) and NESTLE (-10pts).