Zubair Yaqoob

Karachi

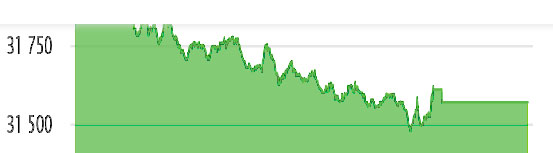

Market continued trading in a narrow range between +39pts and -357pts and closed the session -264pts (-0.8%).International crude posted losses and the same had negative impact on local oil & gas listed chain from E&P to OMCs. PSO and PPL also had financial results today, which were mostly in line or better than expectation, however, near term risks kept pressure on both the scrips till end, although PPL saw price jacking up post result announcement after an initial drop.

Power sector led the volumes table with 16.9M shares, followed by Technology (15.7M) and O&GMCs (13.1M). Scrip wise activity shows KEL leading the volumes with 14.9M shares, followed by WTL (12.4M and PSO (6.9M). The Index closed at 31,565pts as against 31.829pts showing a decline of 264pts (-0.8% DOD). Sectors contributing to the performance include Banks (-108pts), Power (-48pts), E&P (-34pts), Fertilizer (-29pts) and Food (-12pts). Volumes increased from 88.8mn shares to 952mn shares (+7% DoD). Average traded value also increased by 6% to reach US$ 26.3mn as against US$ 24.9mn. Stocks that contributed significantly to the volumes include WTL, PSO, MLCF, KEL and HASCOL, which formed 39% of total volumes.