Zubair Yaqoob

Karachi

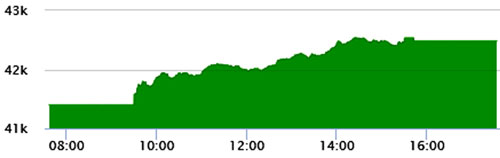

Second trading day of 2020 took the index to an even higher number with an increase of 1144pts and closing the session +1136pts (unadjusted).

Reasons that contributed to the performance of index were rumor of downward adjustment in NSS rates by a significant margin and buying activity from Banks and Foreign Fund, in addition to the recent release of a host of high index targets from various brokerage houses.

Buying activity was mainly observed in Banks, E&P and Cement Sectors. Power sector led the volumes with 58.8M shares, followed by Banks (58.1M) and Cement (36.3M). Among scrips, KEL traded 46.8M shares, followed by BOP (27.7M) and FFL (21.4M). The Index closed at 42,481pts as against 41,400pts showing an increase of 1081pts (+2.6% DoD). Sectors contributing to the performance include Banks (+332pts), E&P (+133pts), Power (+107pts), Cement (+95pts) and Fertilizer (+91pts).

Volumes increased from 330.7mn shares to 412.4mn shares (+24% DoD). Average traded value also increased by 111% to reach US$ 110.2mn as against US$ 52.1mn.

Stocks that contributed significantly to the volumes include KEL, BOP, FFL, UNITY and PAEL, which formed 33% of total volumes. Stocks that contributed positively include HUBC (+101pts), HBL (+85pts), ENGRO (+83pts), UBL (+73pts) and PPL (+67pts).

Stocks that contributed negatively include KTML (-2pts), SHEL (-1pts), GSKCH (-1pts), POL (-1pts), and FHAM (-1pts).