In another historic win for financial inclusion, the first conventional bank granted an Islamic banking license had opened a branch in Cotabato City last Jan. 22. This is CARD Bank, which is one of two domestic players that have applied for a license to operate an Islamic Banking Unit (IBU) in Mindanao.

The other player is a branch of a foreign bank, according to Deputy Governor Chuchi Fonacier of the Bangko Sentral ng Pilipinas (BSP). She said more groups are looking at establishing Islamic banks in the country.

“Given the current monetary conditions as well as global development, we have been getting a clear interest from foreign groups,” Deputy Governor Fonacier was quoted in a recent news report.

These are wonderful developments! Wonderful not because CARD Bank is a member of CARD Mutually Reinforcing Institutions (which I am affiliated with), but because providers of financial services are urgently needed in Bangsamoro Autonomous Region in Muslim Mindanao (BARMM), where poverty is prevalent.

The poverty situation is exacerbated by financial exclusion. Muslim Filipinos’ access to banking and financial services had been limited by their religious beliefs, since Shari’ah prohibits interest-charging or usury (riba) and speculative transactions involving risk (gharar). Unable to access funds for economic activities, many of our Muslims brothers and sisters languish in poverty.

Shari’ah compliant

The Philippines only has one Islamic bank, the state-owned Al Amanah Islamic Investment Bank, created by a presidential decree in 1973.

The BSP’s grant of an Islamic banking unit license to CARD Bank (and hopefully, to more conventional banks in the future) will promote Muslim Filipinos’ access to financial services that are in accordance with their culture and beliefs.

In a news article last Jan. 31, Datu Mohamad Omar Pasigan, chairman of the Bangsamoro Board of Investment, lauded the opening of the first Islamic banking unit in Cotabato City. “This day marks a significant milestone in the banking sector across the Philippines.

BARMM takes pride in the opening of the first-ever Islamic Banking Unit in the country. After extensive deliberations and meetings, we have turned this vision into reality. I hope this is just the beginning, and we will continue to expand to other Islamic cities,” he said.

The same news report quotes CARD Bank President and CEO, Marivic Austria as saying that “their strategic move to open an Islamic branch aims to provide the Muslim community in Cotabato City and BARMM with accessible and culturally sensitive financial solutions.”

She said that their Islamic branch offers a wide range of financial products and services that strictly adhere to Shariah-compliant banking principles. These include: “Wadiah” Deposits accounts, term investment deposits under “Mudharabah,” micro-agri financing and micro-enterprise Financing under “Murabahah” or “Musharakah” contract, and supplemental commodity financing under “Murabahah 2.”

Paving the way

The BSP has taken bold steps to pave the way for the smooth entry of Islamic banking and finance in the local financial ecosystem. After Republic Act No. 11439 (Islamic Banking Law) was enacted in 2019, BSP created the Shari’ah Supervisory Board (SSB) in BARMM in 2022. The SSB’s primary function is to issue Shari’ah opinions on Islamic banking transactions and products, ensuring compliance with the law and promoting Islamic finance and banking in the area.

To generate interest from investors, BSP has issued Resolution 493, approving the modified minimum capitalization requirements for conventional banks with IBUs to expand access to Shari’ah-compliant banking products and services. The guidelines allow conventional commercial banks or subsidiary banks of a universal bank that meet the minimum capital requirement for their respective banking category to operate an IBU within a transitory period not exceeding five years. They will also be given prudential relief in meeting capitalization requirements based on the actual number of branches used for their Islamic banking operations.

More players

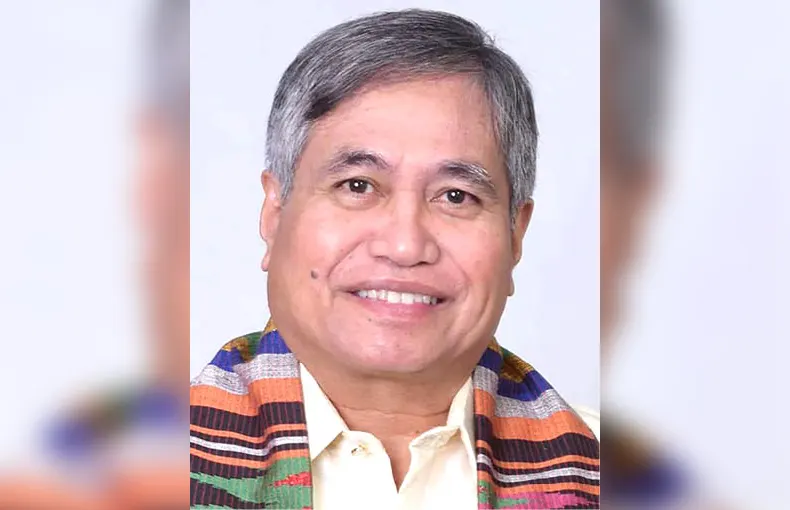

“The objective of the government is to establish a level playing field for both conventional and Islamic banking systems in the Philippines,” says BSP Assistant Governor Arifa Ala in an interview with PTV-4 ‘Laging Handa’ program last Jan. 24. Expounding on the advantages of Islamic finance for both Muslims and non-Muslims, she said that the Islamic banking law “is very flexible” and allows investors a wider choice of investment products.

I certainly hope that BSP’s moves to encourage more conventional banks to venture into Islamic Banking will bear fruit. I wish, too, that the inaugural IBU branch will pave the way for other financial institutions to also become providers of Shari’ah-compliant financial products and services.

By promoting financial inclusion, we can advance development and reduce poverty in BARMM and other Muslim communities. Establishing a strong and vibrant Islamic banking system will also help attract investments in Mindanao and complement the ongoing government efforts to develop BARMM as a dynamic and integral part of the national economy.—Manila bulletin