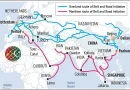

INTERESTING discourse is going on in the country about the strategic role of the SIFC in the CPEC Phase-II which is indeed a healthy sign to seek more and more inflows of foreign direct investment. The prominent policy makers and key organs/departments of the country are striving hard to create bridges of trust, cooperation and collaboration among main stakeholders in the country to gear-up investments.

The ongoing policy adjustment between China-US and China-EU bilateral relations, somehow, provides much needed breathing space for the policy makers of our country to sail through the choppy waters of trans-regional geopolitics which should be used for convergence of the CPEC and SIFC. Rise to geo-economics and policy adjustment towards ASEAN, Central Asia, South Caucasus, Middle East and even Africa should be the way forward for quick economic recovery and seeking more and more investment.

Evidently, the delay in the initiation of CPEC Phase-II has become a hot topic however activation of SIFC provides a rare hope for its revival in the country. Frankly speaking, the Chinese government and its private companies are not responsible for the delay but sudden and unexpected changes incorporated by higher Punjabi bureaucracy about the starting point of the ML-I have become a new flashpoint between two sides. Moreover, political instability is also damaging prospects of Chinese investment for the time being.

Time and again, the Chinese Government and its private companies have been conveying their displeasure and dissatisfaction about the unfriendly attitude and unprofessional approach of the bureaucratic system causing unnecessary delays in the approval, sanction, execution, implementation and completion of many projects under the flagship of CPEC in the country. It has badly damaged the country’s credibility and urge for quick economic recovery. Even the governments of Saudi Arabia and the United Arab Emirates (UAE) have also conveyed their serious concerns about the unfriendly, unproductive and non-participatory approach of our bureaucracy.

The formation of a new group of high bureaucracy comprising true professionals, technocrats, jurists of international law, applied economics, commercial diplomacy, financial experts, media, marketing and last but not the least, conflict resolution must be strategic priorities of the SIFC in the country for gearing up of FDIs and FPIs in the country.

Moreover, formation of an advisory council in the fields of CPEC Phase-II, building of special economic zones, negotiation & settlement of new projects and pending issues with Chinese Government and private companies under the flagship of SIFC should also be key priority. The long pending issues of safety & security of the Chinese workers/investors, deferred dues and derailed projects of the CPEC should be resolved through the “Integrated Joint Security Model and Financial Management”.

Additionally, reallocation of qualitative industries, SEZs of IT, digitalization, modernization/innovation, Artificial Intelligence, green energies, wind, solar, Hydrogen Power Generation, lithium, sand and quantum batteries, EVs, modern/hybrid agriculture (seek technologies/expertise of converting deserts into green lands), technical education for enhancing capacity building mechanism and last but not least Corridor of Knowledge must be pursued under SIFC and converge with CPEC Phase-II.

There is a serious issue with the marketing and branding of CPEC in the country. It is high time to change this perception by transforming its outlook as main engine of immense social development through creating more and more tangible socio-economic prosperity, dignity, job generation, eradication of poverty, empowerment of people, health, education, clean drinking water and, above all, services of humanity in the country, especially in Balochistan. Projects of community development would produce missing trickle down effects in the country.

The SIFC is a necessity of the time as it includes all local stakeholders, such as the civil-military forum, trade bodies, business people, bureaucrats, politicians and others. It is a bouquet of all stakeholders, ensuring that issues faced by industrialists or investors are promptly addressed. However, unrealistic projections of exports up to US$100 billion by our interim investment minister must be rectified accordingly.

There are chronic issues of high price of doing business, lack of incentives, facilitations, corruption, red tape, lack of skilled labour, law & order situation, inconsistent economic & financial policies, existence of cartels & cronies, weak judicial system, unfriendly relations among the centre and provinces, etc., which must be removed for seeking more and more inflow of FDIs in the country. Sincere efforts must be initiated to channelize funds of the domestic banking industries, national savings in the social development projects under SIFC and CPEC and even Islamic Banking would also be effective in this regard. Unfortunately, till today the government failed to attract any foreign investor for solar energy which is a wake-up for the policy makers of the country.

The government’s plan is to bring in upwards of US$100 billion in investment from Gulf Cooperation Council countries through the newly SIFC. However, Pakistan badly needs predictability, transparency and efficiency. Numerous structural reforms in the existing judicial system and, in particular, its ability to adjudicate commercial disputes, enforce contracts and protect intellectual property should be initiated.

There is a long list of projects which Pakistan is pitching for foreign investment to Gulf countries. These projects include Saudi Aramco Refinery in Gwadar, TAPI Gas Pipeline, Thar Coal Rail Connectivity, hydropower projects of 245 MW in Gilgit-Baltistan, handing over of 85,000 acres of land, the establishment of cloud infrastructure, and telecom infrastructure deployment. However, lingering political crisis, economic instability, capacity building of the legal system and moreover hangovers of regional geopolitics are the main hurdles.

It is suggested that seeking FDIs from the GCC should not be personalized as pursued in the past which achieved nothing but personal benefits to the elite.

China has been disappointed with the governance system of Pakistan. The rent-seeking behaviour of many government departments has made it extremely difficult to progress on any project which should be removed as soon as possible.

Agriculture, livestock, mining, minerals, information technology and energy should be prioritized under the flagship of SIFC, however, there should be close liaison with the local businessmen and investors in the country. Public, private partnership is the way forward.

Promoting local industrialisation and implementing a one-window operation to alleviate the burden of dealing with over 60 federal and provincial departments, which currently poses a challenge for business growth should also be key tasks for the SIFC.