In another bid to encourage people to file taxes, the country’s top tax collection authority has increased the withholding tax rate.

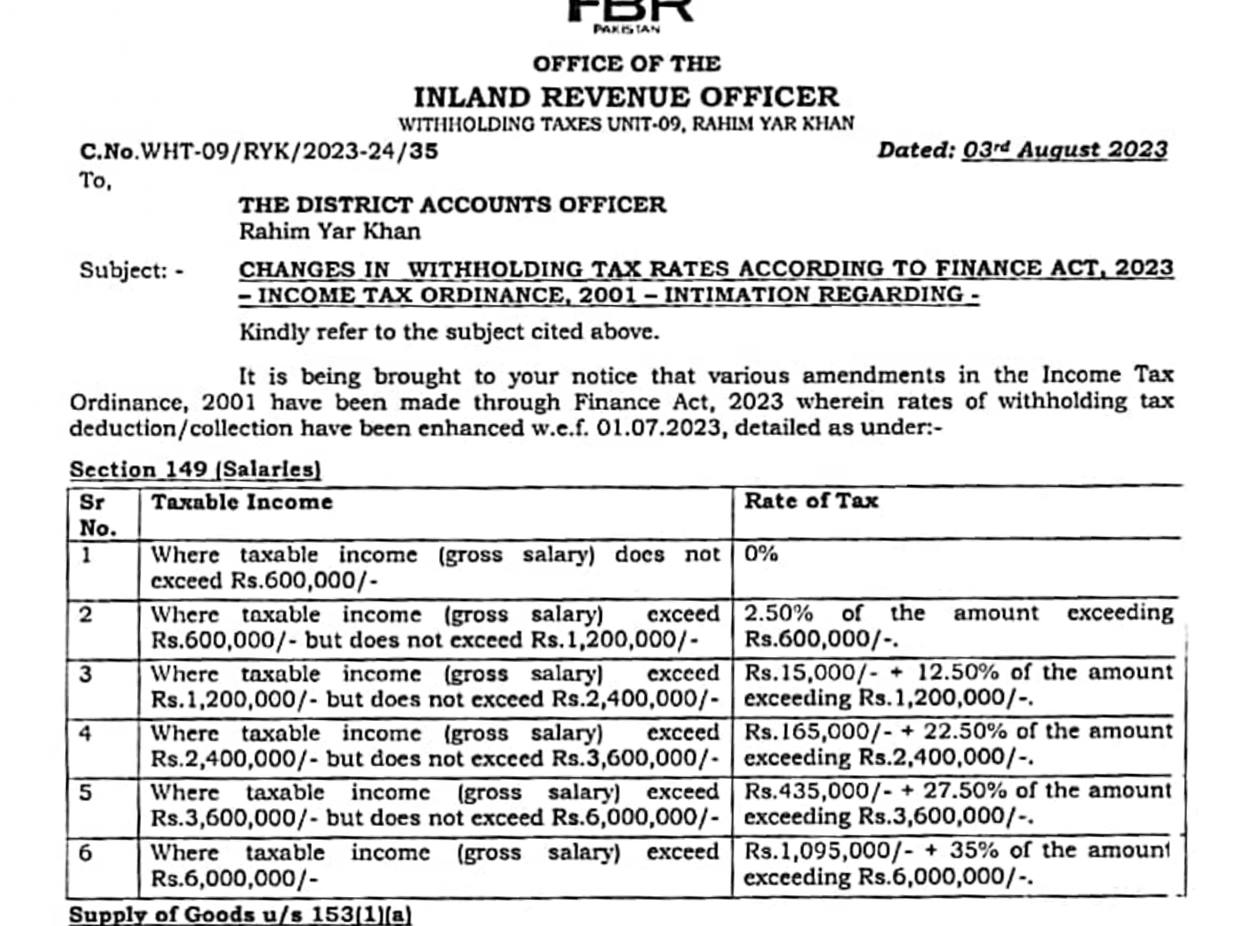

A notification issued by the Federal Board of Revenue of Pakistan cited that the authority has made changes in the Withholding rate for individuals earning above Rs50,000 or Rs1,200,000. For the lowest slab, the tax rate would be 2.5 percent of amount exceeding Rs600,000.

With new changes, Rs15,000 plus 12.50 percent of the amount exceeding Rs12,000,000.

The notification further reads that taxable income (gross salary) exceed Rs24,00,000, and does not exceed Rs36,00,000. Rs 165,000 plus 22.50 percent of amount exceeding Rs24,00,000.

For individuals earning between Rs3,600,000 and 6,000,000, there would be Rs435,000 plus 27.50 percent of amount exceeding Rs3.6 million.

People lying in the top slab, which will be over Rs6 million, would pay Rs1,095,000 plus 35 percent of the amount exceeding Rs6 million.

In a similar development, authorities implemented new tax rates on cash withdrawals to encourage transparency and tax compliance. For non-filers, cash withdrawals above Rs50,000 are subject to higher tax deductions compared to filers.

Filers are now exempt from tax deductions for cash withdrawals under Rs50,000 per day, while non-filers face significant deductions depending on the amount withdrawn. This measure aims to incentivize non-filers to become active taxpayers and contribute to the country’s revenue.

How much tax will be deducted on withdrawal of money from banks?