BRI and Indonesia: Befitting Propositions & Projects

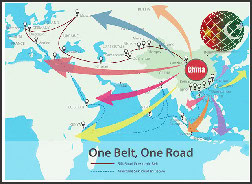

CHINESE One Belt & One Road Initiative (BRI) has become an icon of greater regional connectivity, sustainable development and of course bilateral or trilateral socio-economic integration in the world especially in the Association of Southeast Asian Nations, (ASEAN).

It seems that ASEAN is on track to become the fourth-largest economy in the world. It has a population of more than 650 million with a combined GDP of US$2.5 trillion comprising 3.4 percent of the world’s GDP is one of the ideal destinations and regions for BRI in the world.

Moreover, the ASEAN-led Regional Comprehensive Economic Partnership (RECP) agreement came into force on 1 January 2022 for Australia, Brunei Darussalam, Cambodia, China, Japan, Lao PDR, New Zealand, Singapore, Thailand and Vietnam. With it, ASEAN resolves to keep markets open while strengthening regional economic integration towards post-pandemic inclusive recovery. RCEP could add $209 billion annually to world incomes. Rigorous activation of RECP has further enhanced bilateral and trilateral economic cooperation under the flagship of BRI.

Although ASEAN has some misgivings and deep relations with China but for Indonesia, strategic autonomy of the region is very important and that means that it wants to be engaged with all sides, with all the major powers, without becoming too dependent. Without allowing any of the great powers to impose its hegemony but still desires close economic, trade, investment and social relations with China in which BRI may play an important role. Furthermore, China’s trade with Southeast Asia totaled $685 billion nearly twice that of the U.S., whose trade with the region reached $362 billion.

It is a reality that Indonesia enthusiastically welcomed the BRI and proposed several projects to be financed and constructed within the framework of the Chinese initiative. Among those projects, the most important one was the Jakarta-Bandung High Speed Rail (JBHSR) construction on Java Island that should be completed in 2023.

In the near past, Indonesian president Widodo created a “Sea Toll Road” plan that perfectly aligns with the BRI. Indonesia aimed to direct Chinese investments to four main provinces to help the country’s infrastructure and economic development. The most substantial Chinese investments are not currently in these regions, but interest is warming up.

In this connection, the BRI’s impetus has led to a sixteen fold increase in Chinese investments in Indonesia from 2013 to 2019. Chinese investments went through phases. They started with trading and mining activities but more recently have brought new technology and built infrastructure.

However, in Indonesia, some BRI projects had faced important delays. The slow implementation of BRI projects was partly due to the prudent approach adopted by the Indonesian government regarding the financing of those projects. Contrary to some other Asian nations, Indonesia preferred not to take direct loans from China but favored a business to business approach.

In 2019, President Widodo proposed to China to set up a special BRI Fund for Indonesia. In 2012, Indonesia and China already established a Maritime Cooperation Fund (MCF) to finance a joint project. In June 2017, China agreed to increase this fund in addition to the China ASEAN Maritime Fund (CAMF).

Another cause of delay regards land compensations. It is true especially for large projects like the JBHSR. Several companies and communities have launched lawsuits to seek compensation from land acquisition by the State. Although this process takes some time, this creates good conditions to gain public support for developing projects.

New infrastructure projects under the flagship of BRI will not only create jobs in the construction sector, but will also enable Indonesia to diversify its economy and reduce territorial inequalities.

For China, Indonesia’ s economic recovery is also a major challenge, as the Southeast Asian country is an important customer and could become a destination for Chinese companies to relocate their activities due to Indonesia’s low salaries.

As islands are getting better connected thanks to the BRI, Indonesia will become more attractive to foreign companies and investors. New opportunities will be created in Java, but also in Sumatra, Kalimantan where Indonesia’s new capital city is to be built.

Indonesia, a country that is currently embarking on massive infrastructure development, BRI is considered a good alternative financing source. In fact, Indonesian President Joko “Jokowi” Widodo, was among the seven heads of state from ASEAN to attend the inaugural BRI Forum in May 2017. Jokowi mentioned then that he wanted to see how Indonesia could benefit from BRI cooperation, and after the BRI forum, Indonesia proposed a list of projects for cooperation under BRI.

Indonesia has asked China to set up a special fund within its Belt and Road Initiative (BRI) for investment in Southeast Asia’s largest economy, after offering China projects worth $91 billion (30 projects).

Indonesia has not been among the biggest beneficiaries of China’s trillion-dollar push to create a modern-day Silk Road.

Indonesia says this is because it has insisted any loan within the BRI framework is done on a business-to-business basis to avoid exposing the government in case of default.

The most high-profile BRI venture in Indonesia is a $6 billion high-speed rail project connecting the capital, Jakarta, to the textile hub of Bandung, awarded to a consortium of Chinese and Indonesian state firms in 2015.

Another mega project is a $1.5 billion hydro-power plant, funded by Chinese banks and being built by the Chinese state firm Sinohydro, in the heart of the Batang Toru rainforest on the island of Sumatra, which is home to the endangered Tapanuli orangutans.

To conclude, according to the Asian Development Bank (ADB), Asia faces an infrastructure funding gap of an estimated USD 26 trillion through 2030 in which BRI may play an important role.

Rapid development has become a global priority as countries strive to meet the UN Sustainable Development Goals by 2030. China’s Belt and Road Initiative (BRI), a multi-trillion-dollar push to increase international investment, finance and trade, offers a potential pathway for countries to reach their national development goals. Indeed, Chinese financing is strongly linked with host country economic growth even more so than financing from the World Bank and it is estimated that the BRI could boost global GDP by nearly three percent.

Indonesia is expected to see some of the greatest economic benefits. It is among the top ten recipients of both Chinese foreign direct investment (FDI) and overseas development finance from China’s two largest policy banks the China Development Bank (CDB) and Export-Import Bank of China (CHEXIM) over the last decade.

FDI from China continues to increase rapidly in Indonesia, amounting to over $17 billion during 2015-2020 alone, largely concentrated in three sectors: the metal industry (42 percent), transportation, warehousing and telecommunications (20 percent) and electricity, gas and water (19 percent). Overall, the World Bank anticipates a total of $50 billion could be directed to Indonesia under the BRI.