ZUBAIR YAQOOB

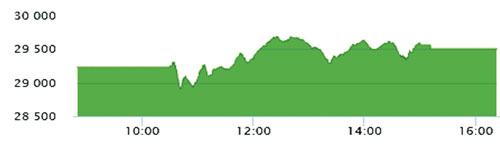

KARACHI Market traded range bound on Wednesday, oscillating between -330pts and +460pts during the session and closed +274pts. CPI release matched street consensus at 10.2% that gave confidence to the investors that the upcoming number would be even lower, raising the hopes that yield on fixed instruments, particularly T-Bills and PIB will dipfurther. Secondary market 5yr PIB was seen trading 9.1%. Wednesday’s trading session saw profit booking as well that kept the overall market range bound, perhaps weakness in global equity and commodities market caused investors to rethink their decision. Cement sector led the volumes with 51.1M shares, followed by O&GMCs (24.6M) and Banks (15.9M). Among scrips, HASCOL topped the chart with 25.8M, followed by MLCF (19M) and KEL (16.8M). The Index closed at 29,506pts as against 29,232pts showing an increase of +274pts (+0.9% DoD). Sectors contributing to the performance include Banks (+46pts), Textile (+37pts), Auto (+33pts), Inv Banks (+33pts) and E&P (+32pts). Volumes declined from 222mn shares to 193.7mn shares (-13% DoD). Average traded value also dipped by 9% to reach US$ 40.1mn as against US$ 44.1mn. Stocks that contributed significantly to the volumes include MLCF, HASCOL, UNITY, OGDC.