Staff Reporter

Karachi

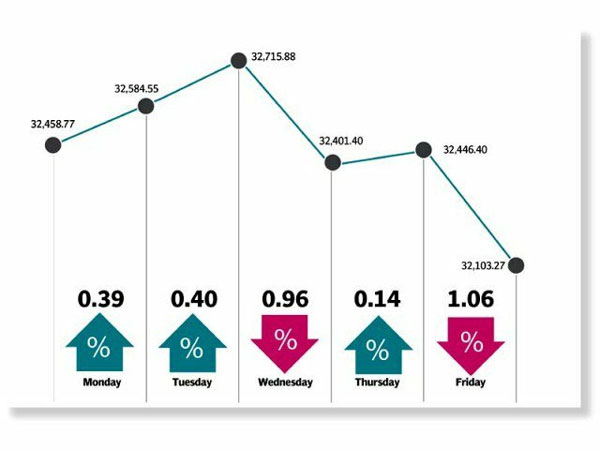

The stock market remained highly volatile, driven by political developments, in the last week as has often been the case in recent months. As a result, the benchmark KSE-100 index closed at KSE-100 index sheds 356 points or 1.1% to settle at 32,103,103 points, shedding 356 points or 1.1% over the week.

Earlier, the week started on a positive note as encouraging news continued to flow in from Prime Minister Imran Khan’s visit to the United States, where he held meetings with US President Donald Trump, key officials of the US Congress and delivered speech at a gathering of expatriate Pakistanis.

Talks covered various issues, most notably the promise of increased trade and improved relations in general between the two countries. As the week progressed, a downturn gripped the market. Opposition political parties staged protests on Thursday (July 25) – exactly one year after the last general elections – in most major cities of the country, denouncing recent reform measures of the government, among other issues. The protests sparked a reversal of market fortunes, leading to a decline in the index in the last trading session.

The World Bank’s draft report, which downgraded Pakistan’s ranking on almost all fiscal management-related indicators, also contributed to the market’s fall. Moreover, the commencement of corporate result season was seen as the key reason behind the KSE-100’s weak performance. Many investors opted to remain on the sidelines amid poor macroeconomic indicators and rapid political developments in the country.

Trading activity slowed down as average daily volumes dropped 29% week-on-week to 75 million shares, while average daily traded value decreased 13% to $21 million. In terms of sectors, negative contribution was led by power generation and distribution companies (down 71 points), food and personal care products (66 points), oil and gas marketing companies (49 points), cement (39 points) and tobacco (27 points). Stock-wise, the negative contribution came mainly from Hubco (down 48 points), Engro (47 points), Nestle (31 points), Mari Petroleum (31 points) and Pakistan Tobacco (27 points). Foreign buying was recorded during the outgoing week as well, which was valued at $8.4 million compared to net buying of $6.4 million last week. Buying was witnessed in commercial banks ($5.6 million) and cement companies ($2.3 million).

On the domestic front, major selling was reported by mutual funds ($13.4 million) and companies ($1.2 million).