Zubair Yaqoob

Karachi

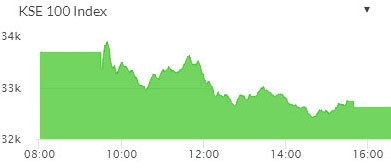

Market opened on a negative note Tuesday with -319pts and 1.4M shares traded at the opening bell. Monday’s negative close of world financial markets, especially US Markets caused damage to investor sentiment and positive opening of US Futures Indices and rebound of international crude oil prices failed to stem the selling pressure. Banks and E&P stocks traded at and near lower circuit breakers. Cement sector traded positive in the early session, however, news of abrupt cancellation of PSL (Pakistan Super League) due to fear of spread of Corona virus reversed the gains in Cement sector. Hope of a major rate cut by Central Bank seems to fade away with Indian Central Bank’s decision to maintain status quo, which also resulted in selling pressure. Cement sector posted trading volumes of 63.3M shares followed by Banks (45.9M) and O&GMCs (20.8M). Among scrips, BOP led the volumes with 24.6M shares, followed by PIOC (20M) and MLCF (15.5M). The Index closed at 32,617pts as against 33,684pts showing a decline of 1068pts (-3.2% DoD). Sectors contributing to the performance include Banks (-531pts), E&P (-147pts), Cement (-85pts), O&GMCs (-65pts), Textile (-63pts) and Fertilizer (+23pts). Volumes increased further from 215.4mn shares to 240.4mn shares (+12% DoD). Average traded value, on the contrary, increased by 40% to reach US$ 71.3mn as against US$ 50.9mn. Stocks that contributed significantly to the volumes include BOP, PIOC, MLCF, HASCOL and UNITY, which formed 43% of total volumes. Stocks that contributed positively include ENGRO (+13pts), FFC (+13pts), EPCL (+10pts), HMB (+7pts) and DGKC (+6pts).