Zubair Yaqoob

Karachi

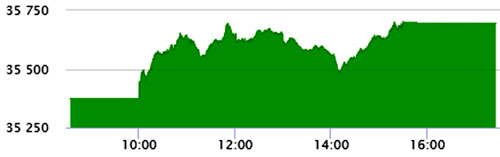

Market gained another 330pts during the session and closed near session’s high at +325pts (unadjusted). Activity was observed almost across the board with Cement and Banks contributing the most. Steel, Pharma, Textile sectors also contributed to the rise. SBP further reduced the rates for ERF facility to Banks, which improved the sentiment for the business community and indicates lowering of financial charges in FY21. SBP is also scheduled for an MPC meeting in the ongoing month. Technology sector posted volumes of 67.7M shares, followed by Cement (44.8M) and Banks (31.8M). Among scrips, TRG topped 38.3M shares, followed by PAEL (20.5M) and MLCF (17.5M). The Index closed at 35,695pts as against 35,374pts showing an increase of 322pts (+0.9% DoD). Sectors contributing to the performance include Banks (+163pts), Autos (+30pts), Technology (+29pts), E&P (+21pts) and Pharma (+19pts). Volumes declined slightly from 333.8mn shares to 317.7mn shares (-5% DoD). Average traded value, on the contrary, increased by 6% to reach US$ 78.2mn as against US$ 73.2mn. Stocks that contributed significantly to the volumes include TRG, PAEL, MLCF, JSCL and WTL, which formed 34% of total volumes. Stocks that contributed positively to the index include HBL (+75pts), UBL (+35pts), PPL (+25pts), TRG (+24pts) and MTL (+20pts).