Zubair Yaqoob

Karachi

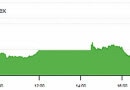

Market went down in the early part of the session, declining by 368pts but rebounded later to erase all losses and closed +353pts (unadjusted). The intra-day movement amounted to 723pts. Fertilizer sector contributed to the positivity, mainly on the back of EFERT and FFC, which was further aided by a rebound in E&P stocks (OGDC and PPL). Among Banks, BAFL and MCB, which were positive on the last trading day due to FTSE rebalancing, sustained price losses but otherwise the banking sector stocks some brisk buying activity, especially FABL, which hit upper circuit. Technology sector realized trading volume of 19.6M shares, followed by Cement (18.1M) and Banks (12.8M). Among scrips, UNITY topped the volumes with 11.5M shares, followed by MLCF (8.2M) and TRG (7.3M). The Index closed at 33,738pts as against 33,438pts showing an increase of 299pts (+0.9% DoD). Sectors contributing to the performance include Fertilizer (+120pts), E&P (+64pts), Power (+33pts), Banks (+25pts) and Autos (+23pts). Volumes increased from 105.9mn shares to 161mn shares (+51% DoD). Average traded value also increased by 83% to reach US$ 36.8mn as against US$ 20mn. Stocks that contributed significantly to the volumes include UNITY, MLCF, TRG, HASCOL and HUMNL, which formed 25% of total volumes.