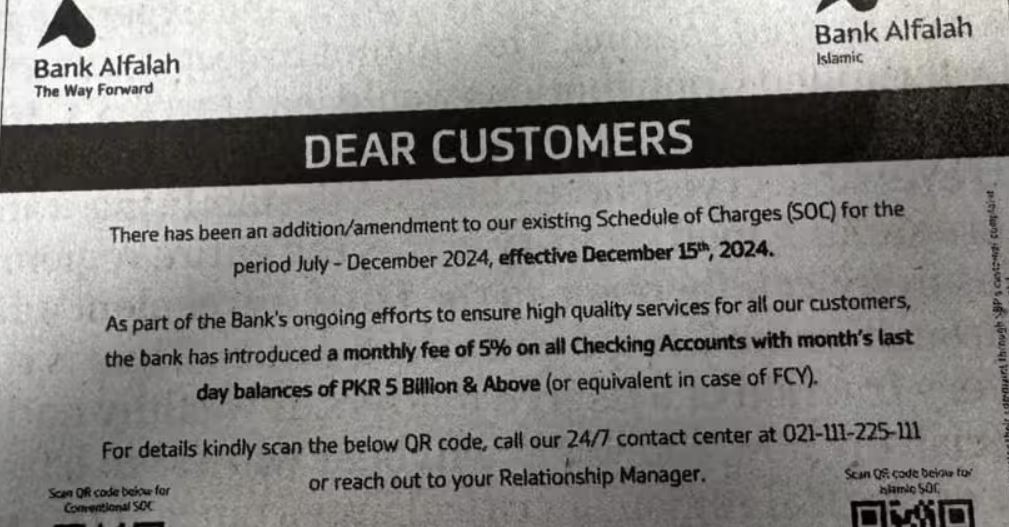

ISLAMABAD – Bank Alfalah, a key commercial bank in Pakistan, has imposed a five percent monthly fee on all checking accounts with the month’s last-day balances of Rs5 billion and above.

Reports shared by digital publications claimed that the bank made changes in its existing schedule of charges for July-December 2024.

Under new rule amendments, a five percent monthly fee will be applied to deduct the minimum sum of Rs250 million per month from big-value accounts with a minimum deposit of Rs5 billion.

The incumbent authorities introduced a 16pc tax on commercial banks with an Advance-to-Deposit Ratio (ADR) of less than 50% amid broader efforts to stimulate credit flow to the private sector and slash the growing financing gap. It was directed that failure to meet new lending targets will attract penalties.

The tax measure is seen as a direct push to increase credit availability for businesses and consumers. At least, a dozen banks in Pakistan received temporary relief from the Islamabad High Court, blocking the government’s new tax on lenders whose private sector lending is below 50pc of their deposits.

The court ruled that no tax can be collected until final decision is made on banks’ petitions, with hearing scheduled for December 3. This tax is part of new efforts to boost revenue under its IMF loan agreement.

Faysal Bank announces robust financial results for first half of 2024