ISLAMABAD – The Directorate of National Savings or Qaumi Bachat has announced a decrease in profit rate on Special Savings Certificates with effect from November 4, 2024.

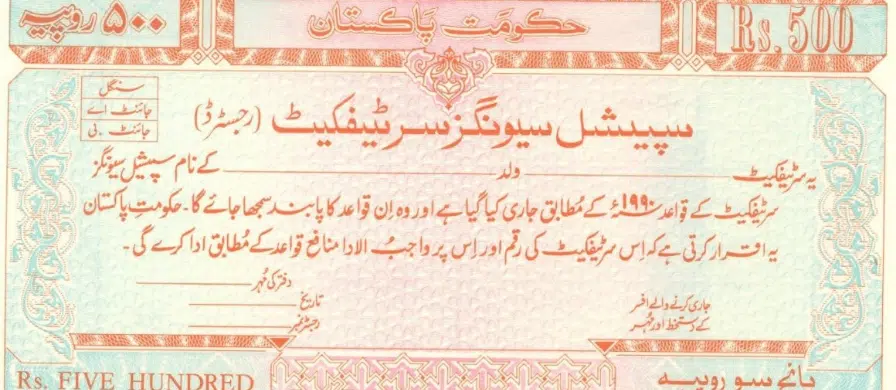

The Pakistani government launched the Special Savings Certificates with an aim to cater the needs and demands of small and medium range investors with a unique investment opportunity of bi-annual returns on their investments.

With a tenure of three years, the investment offer is for the general public. Profit is paid to the investors on the completion of each period of six months.

There is no investment limit in this category as Pakistani citizens can buy the certificates for any amount, starting from Rs500.

Special Savings Certificates Profit Rate from Oct 2024

As per the revised policy, the profit rate for Special Savings Certificates has been fixed at 11.60 percent for first five bi-annual profits while it will be 12.60% for sixth profit.

Profit No 1 to 5 11.60% per bi-annual or Rs5,800 on investment of Rs100,000 each

Profit No 6 (Last) 12.60% per or Rs6,300 on investment of Rs100,000 each

Tax Deduction

The rate of tax to be deducted shall be as follows:

Filers: Persons appearing in Active Tax Payer List (ATL), Rate of Withholding Tax shall be 15% of the yield/profit irrespective of date of investment and amount/profit.

Non-Filers: Persons not appearing in Active Tax Payer List (ATL), Rate of Withholding Tax shall be 30% of the yield/profit irrespective of date of investment and amount/profit.