KARACHI – The Central Directorate of National Savings or Qaumi Bachat Centre has once again revised down the profit rate on various products including Regular Income Certificates with effect from November 2024.

The cut in profit rates is attributed to declining inflation rate and positive economic indicators in the country.

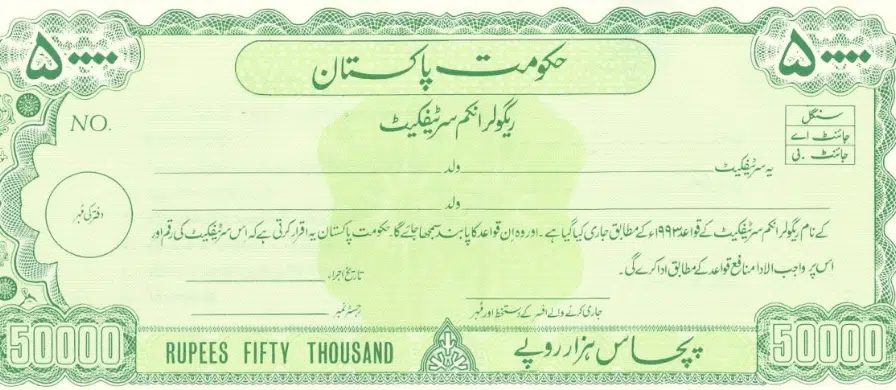

The government launched the Regular Income Certificates (RICs) with a maturity period of five years in 1993 to cater the monthly requirements of the general public.

The certificates are available in the denominations of Rs. 50,000, Rs. 100,000, Rs. 500,000, Rs. 1,000,000, Rs.5,000,000 and Rs.10,000,000.

Profit on the Regular Income Certificates is paid on monthly basis to the investors starting from the date of issue of certificates.

Profit on Each Rs100,000 Investment in Regular Income Certificates

As per the revised rates announced in November, the profit rate on Regular Income Certificates has been decreased to 12.10 percent from previous 12.72%.

The Qaumi Bachat Bank previously offered Rs1,060 per month on each Rs100,000 investment. However, the profit has now been decreased to Rs1,010 by the government.

Zakat Deduction

The investment made in Regular Income Certificates is exempted from Zakat Deduction.