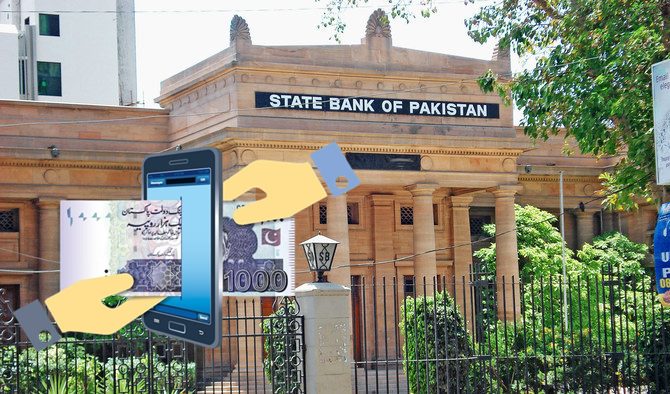

KARACHI – The State Bank of Pakistan (SBP) has given in-principle approval to Toko Lab Private Limited and Accept Technologies Private Limited (M/s PayMob) for establishing as an Electronic Money Institution (EMI) and Payment System Operator (PSO)/Payment Service Provider (PSP) respectively.

The EMI and PSO/PSP will now develop their infrastructure and readiness within six months for applying to SBP for permission to initiate pilot operations. SBP has also granted approval to M/s HubPay Private Limited for initiating pilot operations as an EMI after assessing its readiness to initiate pilot operations.

Now, four (04) EMIs namely M/s NayaPay, M/s Finja, M/s SadaPay and M/s Akhtar Fuiou Technologies are in commercial operations, three (03) EMIs namely M/s Wemsol, M/s E-Processing System and M/s HubPay are in pilot operations, whereas three (03) EMIs namely M/s YAP, M/s Cerisma, and M/s Toko Lab have in-principle approval for establishing their readiness for pilot operations.

As of September 30, 2024, EMIs have opened 4.2 million wallets, issued 4.6 million payment cards and have outstanding E-money deposits of PKR 5.7 Billion. On a year-on-year basis, the e-money wallets have increased 76.5 %, cards issuance by 41.4 % and e-money deposits by 87.5%.

Further, during the first three quarters i.e. Jan to Sep of 2024, a total of 82.1 million payments were made through E-wallets offered by EMIs amounting to PKR 231.9 billion, showing a significant growth of 117% and 163% respectively as compared to the corresponding period in last year.