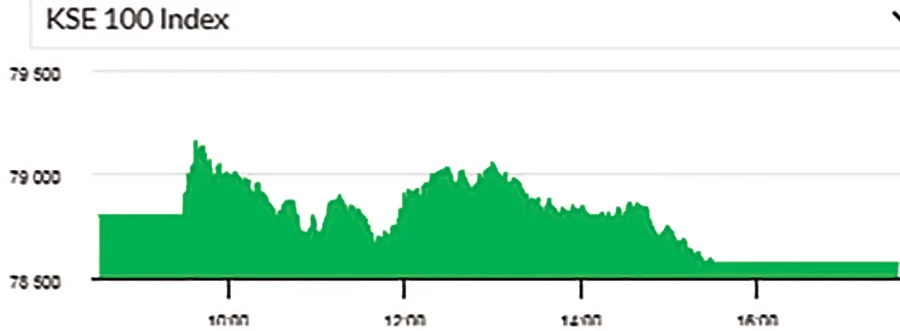

The 100-Index of the Pakistan Stock Exchange (PSX) shed 230.37 points on Monday, showing a negative change of 0.29 percent, closing at 78,571.06 points against 78,801.43 points on the last working day.

A total of 512,337,206 shares were traded during the day as compared to 682,409,886 shares the previous day, whereas the price of shares stood at Rs 18.894 billion against Rs 18.168 billion on the last trading day.

As many as 433 companies transacted their shares in the stock market, 150 of them recorded gains and 242 sustained losses, whereas the share price of 41 companies remained unchanged.

The three top trading companies were Symmetry Group Limited with 59,366,445 shares at Rs 7.69 per share, Kohinoor Spinning with 50,616,021 shares at Rs.10.52 per share and WorldCall Telecom with 24,441,228 shares at Rs 1.28 per share.

Hoechst Pakistan Limited witnessed a maximum increase of Rs.189.64 per share price, closing at Rs 2,086.04, whereas the runner-up was Hallmark Company Limited with a Rs 51.70 rise in its per share price to Rs 568.70.

Nestle Pakistan Limited witnessed a maximum decrease of Rs87.85 per share closing at Rs 6,887.15 followed by Abbott Laboratories Limited with Rs 76.28 decline to close at Rs 723.88.—APP