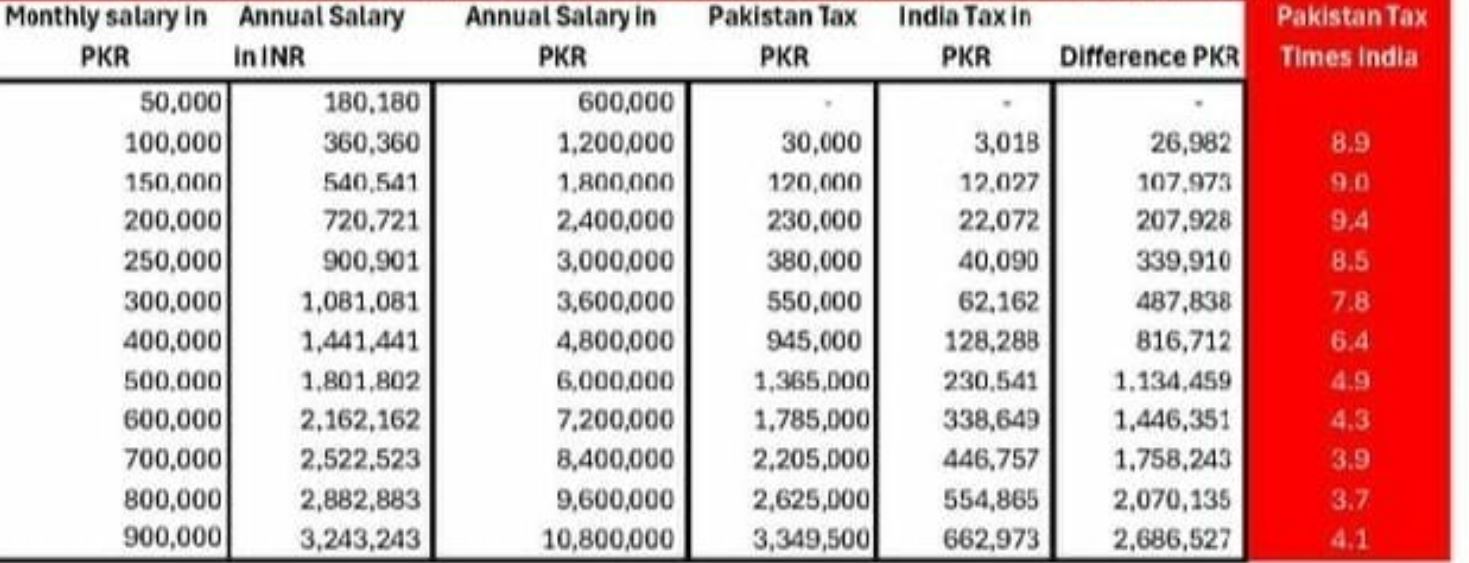

ISLAMABAD – People in Pakistan are paying record-high taxes, with salaried class bearing the brunt amid back-breaking inflation. Lately, the Pakistan Business Council (PBC) reported that salaried employees in Pakistan pay up to 9.4 times more in taxes than India, despite similar living costs.

It said a high tax burden in the country does not correspond with better value or equity in tax system.

Pakistan vs India Salary Taxes 2024

| Monthly Salary (PKR) | Annual Salary (PKR) | Annual Salary (INR) | Tax (PKR) | Tax (INR) | Difference (PKR) |

| 50,000 | 600,000 | 180,180 | No Tax | No Tax | 26,982 |

| 100,000 | 1,200,000 | 360,360 | Rs30,000 | 60,000 | 720,721 |

| 150,000 | 1,800,000 | 540,540 | Rs120,000 | Rs12,000 | 1,081,081 |

| 200,000 | 2,400,000 | 720,720 | Rs230,000 | Rs22,000 | 1,441,441 |

| 250,000 | 3,000,000 | 900,900 | Rs380,000 | Rs40,000 | 1,801,802 |

| 300,000 | 3,600,000 | 1,081,080 | Rs550,000 | Rs62,000 | 2,162,162 |

| 400,000 | 4,800,000 | 1,441,440 | Rs945,000 | Rs128,000 | 2,522,523 |

| 500,000 | 6,000,000 | 1,801,800 | Rs1365,000 | Rs230,000 | 3,243,200 |

| 600,000 | 7,200,000 | 2,162,160 | Rs1,785,000 | Rs338,000 | 4,963,646 |

| 700,000 | 8,400,000 | 2,522,520 | Rs2,205,000 | Rs446,000 | 6,681,831 |

| 800,000 | 9,600,000 | 2,882,880 | Rs2,625,000 | Rs554,000 | 8,564,716 |

| 900,000 | 10,800,000 | 3,243,240 | Rs3,349,500 | Rs662,900 | 10,446,473 |

The recent stat shows that there is no tax for those earning Rs50,000 per month, while for higher salaries, like PKR 900,000 per month, the tax can exceed PKR 3,349,500 annually.

Consequently, the net annual salary decreases as taxes increase. For instance, a monthly salary of PKR 100,000 leaves a net annual salary of PKR 720,721, whereas a monthly salary of PKR 900,000 results in a net annual salary of PKR 10,446,473 after taxes.

For the unversed, India’s economy is much larger and growing faster than Pakistan’s, with a nominal GDP of $3.7 trillion compared to $400 billion. India has a higher per capita income, a diverse economy with major contributions from services, and attracts substantial foreign investment.

In contrast, Pakistan’s economy relies more on agriculture and manufacturing, experiences higher inflation and currency volatility, and faces challenges in infrastructure development and human development indicators.