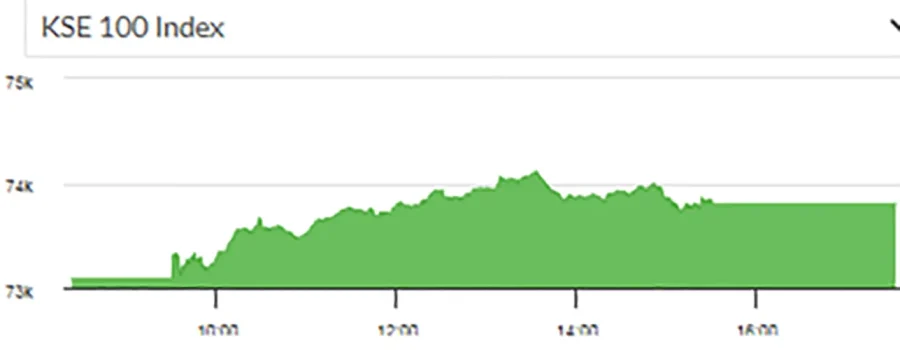

Pakistan’s benchmark share index closed at a record high of 73,822, up 1 percent, after it touched a lifetime peak on Monday, breaching the key level of 74,000 points. The index has surged 78.6 percent over the past year and is up 14.1 percent in the year to date.

During intraday trading, the index hit a high of 74,114 points. On Friday, it closed at a record high of 73,085 points, above the key level of 73,000 for the first time.

Pakistan last month completed a short-term $3 billion International Monetary Fund (IMF) loan program, which helped stave off sovereign default, but the government has stressed the need for a fresh, longer-term program.

An IMF mission led by its chief will meet with authorities in Pakistan this week to discuss a new program, ahead of Islamabad beginning its annual budget-making process for the next financial year, the IMF resident representative for Pakistan said on Saturday.

Amreen Soorani, head of research at JS Global Capital, said stock market valuations were recovering as talks with the IMF and reforms progressed, and foreign investors showed interest. She said slowing inflation had also helped the rally.

Pakistan’s consumer price inflation slowed to 17.3 percent in April from a year earlier, the lowest reading in nearly two years and below the finance ministry’s projections.