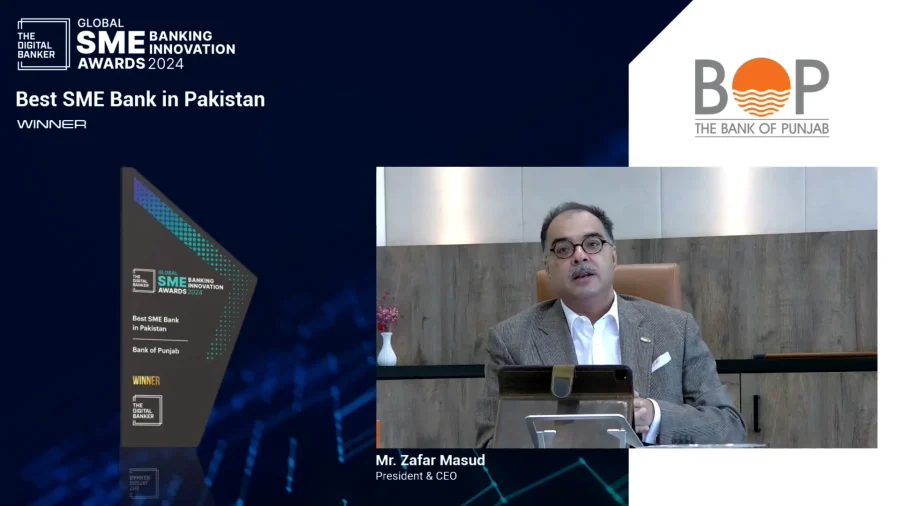

The Bank of Punjab is thrilled to receive the prestigious title of “The Best SME Bank in Pakistan” during the Global SME Banking Innovation Award 2024 Gala by The Digital Banker.

This acknowledgment underscores the bank’s unwavering dedication to fostering the growth and prosperity of SMEs in Pakistan, showcasing its outstanding performance in pioneering digital innovation, advancing financial inclusivity, and offering steadfast support to this vital sector.

A key driver of BOP’s success lies in its primary focus on financial inclusivity. It actively provides accessible banking services, conducts financial literacy programs, and offers customized financing solutions to empower SMEs. As one of the largest Commercial Banks in the country providing Collateral-Free Loans to SMEs, it recognizes that genuine success stems from grass root level efforts and the uplifting of marginalized segments.

Diversity, Equity, and Inclusion are foundational to its strategy across all sectors. In its pursuit to address disparities and empower women in Pakistan, BOP, under its Naz Proposition initiative, is actively engaging, recognizing, and harnessing the vast potential this segment offers. Despite challenges, it has successfully extended a significant number of loans to women-led businesses, addressing issues such as access to finance, lack of collateral, and volatile interest rates.

Another cornerstone of BOP’s success lies in its tailored digital banking solutions for SMEs. Spearheading innovation, the bank introduced the first End-to-End (E2E) digital lending product of the commercial banking industry in the market, empowering small entrepreneurs with seamless and efficient financial delivery to navigate the complexities of the modern-day business landscape. The bank’s exclusive SME Digital Portal streamlines the lending process for its customers.

Innovative credit evaluation methodologies further distinguish BOP’s approach. It introduced a Regression-Based Statistical scorecard model for credit evaluation, specifically tailored for extending loans to Small Enterprises (SE). Applicants are engaged through recorded communication, and loans are granted utilizing a Q&A based cash flow-centric lending framework, assessed via Digital Scorecards.

Additionally, the bank has embarked upon a ground-breaking partnership with a Tech Company for an advanced Artificial Intelligence (AI) empowered digital infrastructure project aimed at evaluating scope 3 emissions, furthering its commitment to ESG considerations in SME Financing.

Expressing gratitude at this recognition, Mr. Zafar Masud, CEO of The Bank of Punjab, remarked: “We are honoured to be recognized as the Best SME Bank by The Digital Banker. This award validates our dedication to SMEs success in Pakistan. We remain committed to innovating and delivering cutting-edge financial solutions to empower small businesses and stimulate economic growth.”

The Bank of Punjab’s recognition as the Best SME Bank in Pakistan reaffirms its position as a leader in the financial industry, setting the stage for a future marked by continued innovation, inclusivity, and sustainable economic development.