The National Savings Organization, also known as the Qaumi Bachat Bank, is Pakistan’s largest financial institution. Its portfolio is worth over Rs3.4 trillion, and it serves over four million customers nationwide.

The bank has played a significant role in promoting a savings culture in Pakistan and has also generated funds for the government to finance budgetary deficits and infrastructure projects.

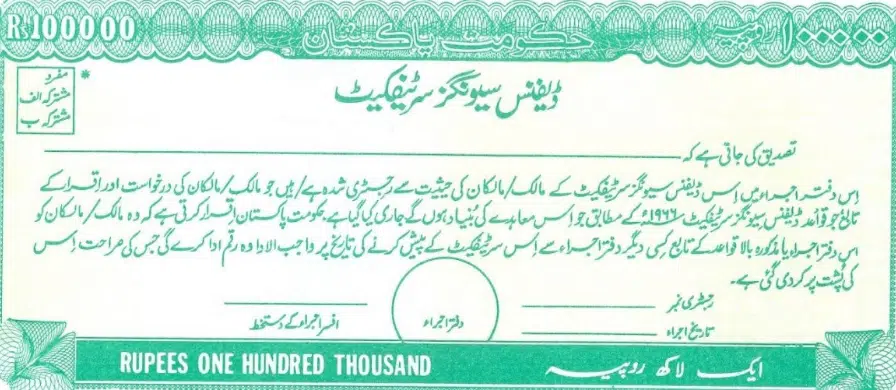

The bank offers various products, including Defence Savings Certificates, which can be purchased by Pakistani nationals and overseas Pakistanis. These certificates have a maturity period of 10 years and come in denominations of Rs.500, Rs.1,000, Rs.5,000, Rs.10,000, Rs.50,000, Rs.100,000, Rs.500,000, and Rs.1,000,000.

To purchase a Defence Savings Certificate, customers can deposit cash, cheque, draft, or pay order at the Issuing Office. The certificates can be encashed at any time after the purchase date but no profit is payable if encashment is made before the completion of one year. Taxes are applicable on these certificates.

The bank recently revised the profit rates of its different products, including Defence Savings Certificates. According to the latest update, the profit rate for Defence Savings Certificates stands at 14.1%.