The benchmark index of the Pakistan Stock Exchange continued its record shattering bullish run on Monday and closed in on the milestone of 60,000 points.

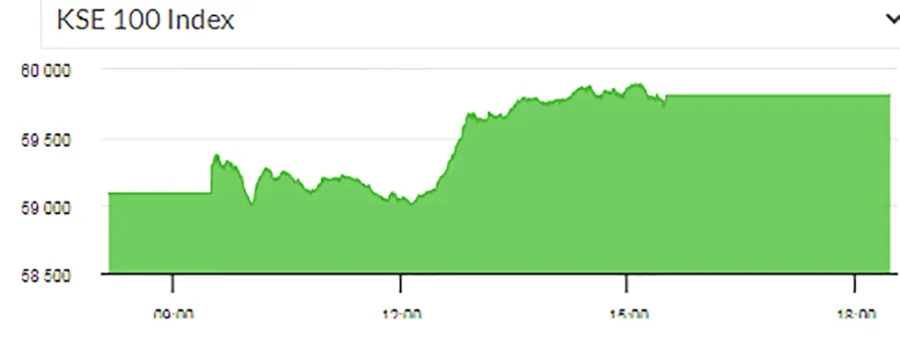

According to the PSX website, the KSE-100 index had recorded marginal gains until noon. However, at 1:11pm, it witnessed a sudden surge which continued until closing time. The index closed at 59,811.34, up by 724.99 points, or 1.23 per cent, from the previous 59,086.35.

In the previous session on Friday, the benchmark KSE-100 index had touched a new record of 59,100 points, thanks to excellent corporate profits, reduced economic volatility, the successful conclusion of a staff-level deal with the International Monetary Fund, expectations of a post-poll ‘stable’ government and optimism about the early reversal of monetary tightening, share prices have jumped rapidly in the last three months. Commenting on Monday’s rally, Raza Jafri, head of equity at brokerage company Intermarket Securities, said, “The banking sector is leading the rally with the sector’s outlook improving in tandem with the economy.”

He highlighted that banks offer a blend of high dividend yield and attractive valuations, and have consistently been a favourite for foreign investors.

Shahbaz Ashraf, chief investment officer at FRIM Ventures, a Karachi-based investment company, attributed the rally to “cheap valuations and flush of liquidity”.