Pakistan Stock Exchange (PSX) landed in a bearish territory as investor pessimism enveloped the market over the latest round of rupee depreciation and a number of other discouraging developments, putting the benchmark KSE-100 index under constant pressure.

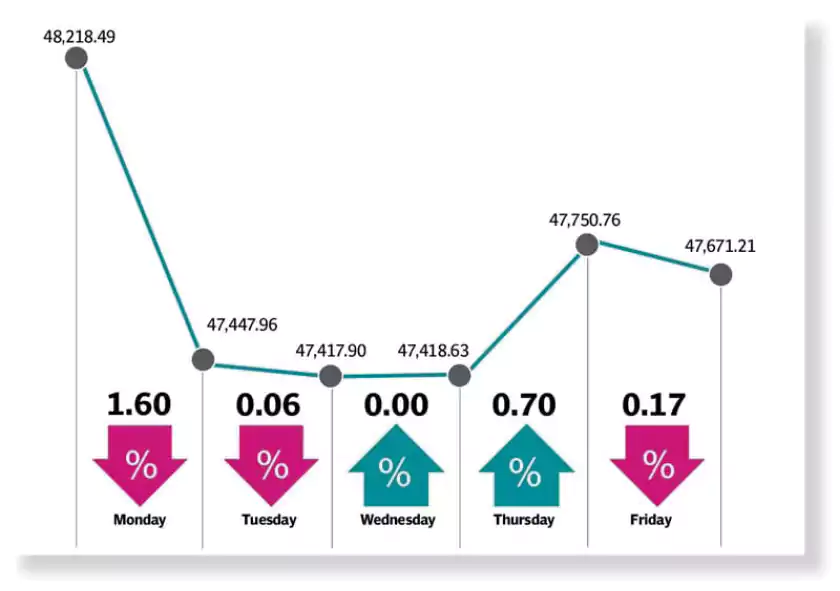

The trading week commenced on a negative note when it slumped over 700 points,

The downtrend persisted the next day as well with investors remaining under pressure over continuous free fall of the rupee that touched an all-time low, expected hike in the key policy rate and concerns over dismal data showing a $809 million current account deficit.

Factors such as rupee fluctuation and a rising power tariff that impacted the economy kept investors on sidelines, who opted for cautious trading on Wednesday. The market closed flat.

On Thursday, the KSE-100 index broke its losing streak after four days of losses as investors were buoyed by virtual talks between Pakistan and the International Monetary Fund (IMF) over the energy sector.

The optimism, however, could not be sustained and the index fell on Friday, driven by negative cues like inflation, rising power tariff and persistent rupee fall, which aggravated the bearish mood of investors. The benchmark KSE-100 index dropped by 547 points, or 1.1%, compared to the previous week, settling at 47,671.

According to JS Global analyst Muhammad Waqas Ghani, the week commenced on a pessimistic tone and the unfavourable momentum continued as investors opted to lock in profits due to uncertainty on both the political and economic fronts.

During the week, the rupee continued to depreciate with the PKR/USD inter-bank rate losing 1.7% week-on-week. The gap between open market and inter-bank rates widened to 5.4% compared to the IMF’s recommendation of maintaining a maximum difference of 1.25%.

Given Pakistan’s status as a net importer, the movement of PKR/USD has a significant influence on its Consumer Price Index (CPI) basket.

In other news, initial discussions were held on energy-sector issues where the caretaker finance minister led the meeting. Pakistan also engaged in virtual talks with the IMF regarding losses in the energy sector. Primary focus was on reducing circular debt during the ongoing fiscal year.

The IMF also urged the government to formulate a strategy for eliminating the energy-sector circular debt.