Fulfilling another demand of the International Monetary Fund to revive its loan programme, Pakistan’s central bank jacked up its key policy rate by 100 basis points to a new record high at 22 per cent in an emergency meeting on Monday. The rate would become effective from Tuesday.

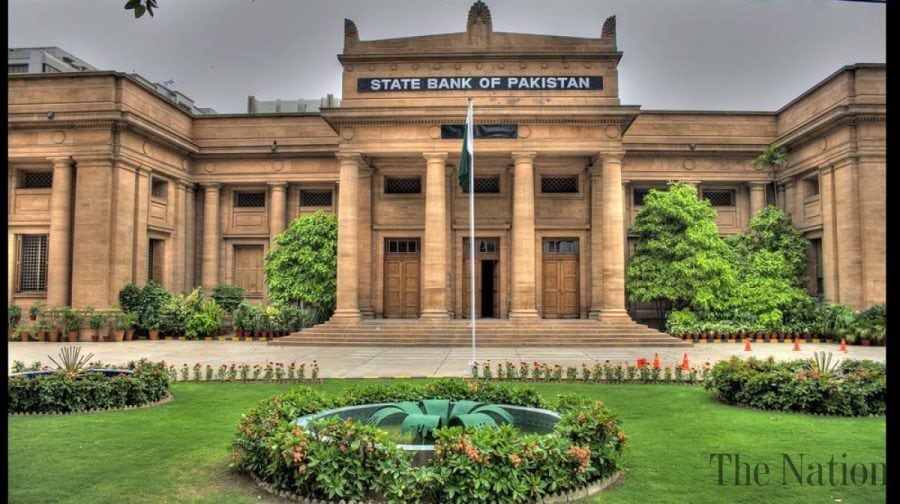

The State Bank of Pakistan said the increase in the rate was inevitable considering the outlook for inflation was deteriorating. The country has recorded six-decade-high inflation reading at 38 per cent in May 2023.

The bank said on its official Twitter handle, “MPC (monetary policy committee) of SBP convened an emergency meeting Monday, where it noted that potential upside risks to the inflation outlook have increased from the last meeting (June 12, 2023), and accordingly decided to raise the policy rate by 100bps to 22%.”

“MPC views that these risks are mainly coming from the implementation of new measures in the fiscal and external sectors, which are important in the context of completion of the ongoing IMF programme.”

The MPC noted that the action is necessary to keep the real interest rate firmly in positive territory on a forward-looking basis that would help in bringing down inflation towards the medium-term target of 5 – 7 per cent by the end of FY25.