Pakistan stock exchange experiences 65-point decline

Pakistani rupee gained 59 paisa against the US Dollar in the interbank trading on Friday and closed at Rs285.15 against the previous day’s closing of Rs285.74.

According to the Forex Association of Pakistan (FAP), the buying and selling rates of dollars in the open market were recorded at Rs308 and Rs311, respectively.

The price of the Euro decreased by 53 paisas to close at Rs306.11 against the last day’s closing of Rs306.64; according to the State Bank of Pakistan (SBP).

The Japanese Yen remained unchanged and closed at Rs2.04, whereas a decrease of Rs1.59 was witnessed in the exchange rate of the British Pound, which traded at Rs352.07 as compared to its last day’s closing of Rs353.66.

The exchange rate of the Emirates Dirham and the Saudi Riyal declined by 16 paisas and 11 paisas to close at Rs77.65 and Rs76.03; respectively.

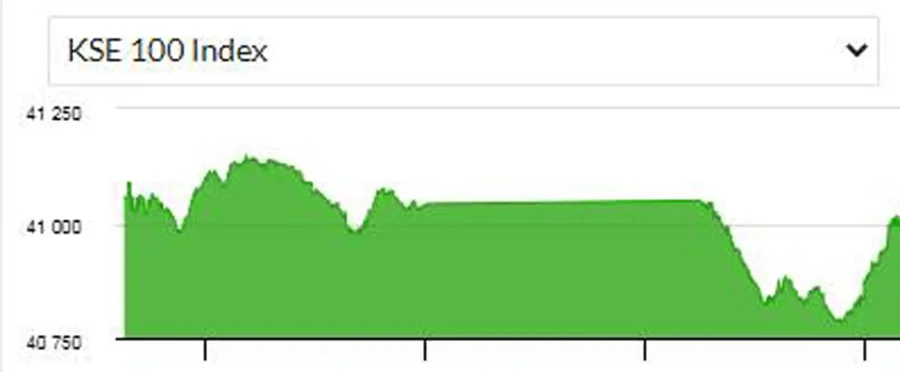

Meanwhile Pakistan stocks closed lower by 65 points on Friday after a mixed trading session throughout the day. The Pakistan Stock Exchange (PSX) witnessed a decline in the benchmark KSE-100 index, which concluded at 40,965 points, down from the previous day’s closing of 41,030 points. Market analysts from Arif Habib Limited observed that the PSX commenced with a lackluster session, as investor participation remained subdued due to the ongoing political turmoil in the country.

However, following the mid-session break, investor activity surged significantly, causing the bears to dominate the KSE-100 index, resulting in a decline of 246 points during intraday trading.

During the final trading hour, investors opted to enhance the value of their portfolios by selectively investing in stocks.

Trading volumes notably increased from the previous close, driven by the end of the rollover week, with the cement sector garnering significant attention.

Several sectors contributed to the overall market performance, with Technology & Communication (-73.4 points), Exploration & Production (-56.3 points), Commercial Banks (-41.7 points), Oil Marketing Companies (-31.4 points), and Pharmaceuticals (-14.3 points) experiencing a decline.

The volume of shares traded rose from 125.3 million shares to 168.5 million shares (representing a 34.4 percent day-on-day increase). Moreover, the average traded value witnessed a substantial surge of 67.3 percent, reaching USD 23.8 million compared to the previous value of USD 14.1 million.

Prominent stocks that contributed significantly to the trading volumes included WTL, MLCF, NBP, KEL, and TPLP.

Overall, the Pakistan stock market witnessed a decline in the KSE-100 index amid mixed trading sessions and increased investor activity, impacted by the ongoing political situation.