AT a time when the country is faced with a serious liquidity crunch and direly needs the inflows of dollars, export decline is really alarming which is going to further worsen the situation.

According to the data released by State Bank of Pakistan, the country’s exports to nine regional countries shrank 11.93 per cent in the first half of current fiscal year mainly driven by a drop in shipments to China.

Overall export situation is also disturbing as according to Pakistan Bureau of Statistics these declined to $ 14.25 billion during the first six months of the current fiscal year as compared with $ 15.13 billion dollar in the corresponding months of the last fiscal year.

During the last fiscal year, the country had posted a reasonable growth in exports and these remained over thirty one billion dollars.

The same was the case in remittances. But during the current year, a major decline is being seen both in exports and remittances which is hurting the economy and making the balance of crisis more serious.

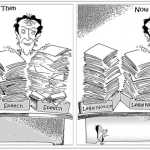

Issues hurting the exports and remittances must be checked immediately. Non-opening of LCs because of low foreign exchange reserves has brought to the fore the issue that how much our export-oriented industry is dependent on imported raw material.

Owing to the shortage of raw material, the textile industry is in a serious crisis and failing to meet export orders.

Only in this industry, about seven million people have been laid off. Manufacturing sector is also faced with the same dilemma.

If this situation persists, the country will never be able to get out of debt trap and every now and then will continue to face the liquidity crunch.

It is really time to pursue a holistic approach to address the problems faced both by the agriculture and industrial sector.

Incentives should be given in order to encourage the local production of raw material and in case of textile, there is a dire need to significantly bolster the production of cotton.

In case of auto industry, we should move beyond from being assemblers only to localizing parts of vehicles.

This will really keep the country on a sustainable growth trajectory and to a great extent will save us from the negative impact of external factors.