Staff Reporter

Karachi

Stocks replicated the performance of the previous session, albeit closing on a negative note amid institutional profit-taking and lack of positive triggers.

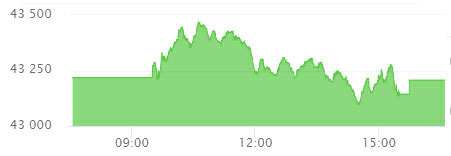

The KSE-100 opened on a positive note and marched up to hit an intra-day high of 43,468.22 points. However, the momentum could not be sustained as certain economic indicators dragged the index in the red. The dismal data regarding auto sales and forecasts of higher inflation and fiscal deficits by Fitch kept investors cautious.

At close, the benchmark KSE 100-share Index recorded a decrease of 11.63 points, or 0.03%, to settle at 43,207.04.

According to AHL Research, “Market replicated the performance seen Monday with a sway from +250 points to -123 points and closing the session down 12 points.

Mainly cyclical stocks faced the music with major selling pressure was witnessed in cement (due to higher coal prices) and steel sector. E&P sector also saw selling pressure, whereby OGDC, PPL and POL traded in red territory.

“EPCL also faced heavy selling after announcement of issuance of preference shares. Banking sector stocks remained in the limelight with trading volumes of 44.7 million shares, followed by technology (42.4 million) and cement (26.6 million).”

Stocks that contributed positively include ENGRO (+45 points), UBL (+34 points), HUBC (+23 points), DAWH (+20 points) and EFERT (+7 points).