Financial emergency: Where have all the dollars gone?

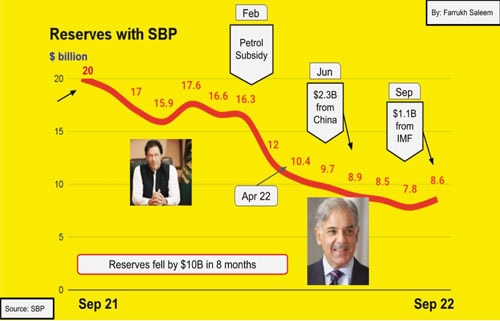

In August 2021, net reserves with the State Bank of Pakistan (SBP) stood at a hefty $20 billion.

By April 2022, when Mian Muhammad Shehbaz Sharif took oath of the prime ministerial office, net reserves with the SBP had dropped to $10 billion.

That is a drop of $10 billion in eight months. On 11 April 2022, the day Mian Muhammad Shehbaz Sharif took oath of the prime ministerial office, net reserves with the SBP were just enough to cover around 6 weeks of imports.

How did the PTI government manage to lose a wholesome $10 billion in eight months? From August 2021 onwards, our foreign trade account bled like never before and the SBP was losing an average of $1.25 billion a month, every month for eight months.

By August 2021, alarm bells had started ringing louder than the loudest alarm bells. But the louder than the loudest alarm bells all fell on deaf ears.

Clearly, politics held priority over falling foreign exchange reserves that were falling like ninepins. Clearly, the only way out was the IMF.

Clearly, the PTI government should have completed all the pending IMF reviews and should have used the IMF’s resources to stop the severe bleeding at the SBP. The PTI government did the exact opposite: the PTI government went through a ‘series of policy reversals and slippages’.

The PTI government would make commitments with the IMF, receive a tranche and then go back on its commitments. On 28 February 2022, the former prime minister Imran Khan himself announced the mother of all policy reversals by announcing a subsidy on petrol and diesel.

The following month the SBP bled an additional $4 billion in just four weeks. The alarm bells had begun ringing in August 2021. Pakistan should have revived the IMF program by March 2022.

But Pakistan was too busy politicking. The IMF program was not revived till August 2022-and Pakistan lost six extremely crucial months during which the SBP bled away $12 billion in twelve months.

September 2021 over September 2022, our rupee is down from Rs170-to-a-dollar to Rs237-to-a-dollar. Our rupee is down 40 percent in just one year. Now there are no dollars left; neither in the interbank market nor in the open market.

The difference between the interbank market and the open market has swollen to Rs14 a dollar (which used to be Rs2 a dollar a few months ago). This is a clear indication that dollars are being smuggled out of the open market to Afghanistan-and perhaps Iran.

Then there are the treasury departments The interbank market is where exporters sell their dollars and importers come to buy dollars. Exporters annually sell around $31 billion while importers are in it to buy around $80 billion. Consequently, there are no dollars left in the interbank market either.

In essence, this calls for some sort of a financial emergency under which we need serious measures for energy conservation, drastically reduce government expenditure, open trade with our neighbors and redirect the Rs900 billion federal Public Sector Development Program (PSDP) and the Rs1,700 billion provincial Annual Development Programs (ADP) for flood relief.